Inventory Valuation

Previous Lesson: Costing

Next Lesson: Cost of Goods Sold Statement

Inventory is tangible goods held for resale in the normal course of business or that will be used in producing goods (manufacturer) for sale. Assets not normally held for resale are excluded from merchandise inventory. An important aspect of inventory accounting is determining inventory ownership.

If the buyer is responsible for freight charges (FOB factory or shipping point), ownership passes to the buyer as soon as goods are loaded.

If the seller pays for the freight charges (FOB destination), ownership passes to the buyer only when the goods arrive at the destination.

The cost of inventory includes all expenses made in bringing the goods or assets to their existing condition and location for sale. Inventory cost therefore equals invoice price less discounts (if any), plus transportation, storage, import duties, insurance, and other costs of preparing the inventory for sale. These additional or incidental costs add value to the inventory and should be included in the purchase cost.

1. Inventory Valuation System

Merchandising companies use one of two systems to account for inventory:

1.1 Perpetual Inventory System

A Perpetual Inventory System is one in which continues stock records of inflow and outflow of inventory are kept. Every time a unit of good is bought or sold, such a transaction is updated in the stock records. By doing so, the enterprise can determine the cost of goods on hand (Closing stock) by just looking at the stock records, without the need to perform a stock count. Under this inventory method, the cost of goods sold is determined each time a sale is made. The company’s cost of the merchandise is debited to the CGS expense account at the time of each sale to a customer. Purchases of merchandise are recorded (as increases or debits) in the Inventory The Inventory account is reduced (or credited) each time a sale is made by whatever amount the goods cost the company.

1.2 Periodic / Physical Inventory System

A Periodic Inventory system determines the inventory at the beginning and end of certain periods of time (by physical count) such as annually, semi-annually, quarterly, or monthly. When a business maintains a periodic inventory system, it does not consistently update information about the cost of goods sold, or the stock balance on a particular day. As merchandise is purchased its cost is recorded in the purchase account. No entry is made for cost of goods sold. Therefore, at the end of the period, opening and ending inventories are adjusted against cost of goods sold account or profit and loss account.

>> Practice Inventory Valuation MCQs in order to understand Inventory Valuation.

Video Lecture: Costing Concepts in Urdu & Hindi-Workbook Practice

Click Here To Download Workbook Used in Video

Click Here To Download Workbook Used in Video

2. Inventory Valuation Methods

Two methods are used to value the inventory:

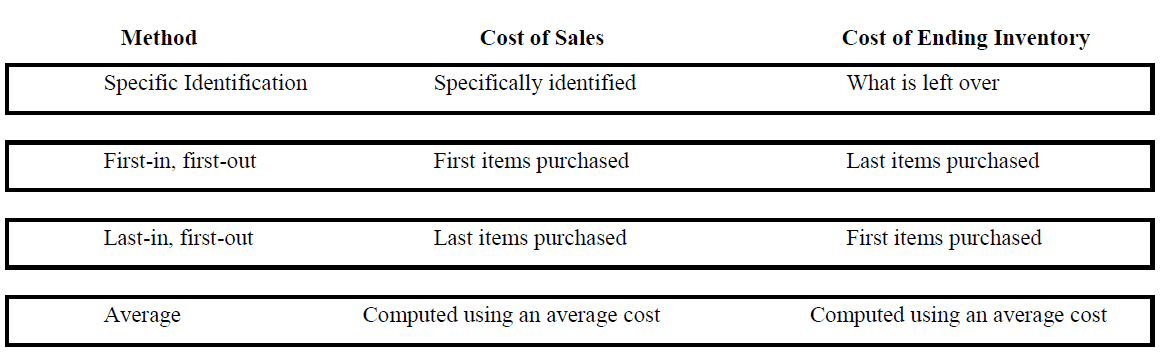

2.1 Specific Identification Method

The Specific Identification Method can only be used for items that can in some way be labeled and identified (Heterogeneous). The specific identification inventory costing method identifies and uses the purchase invoice of each item sold to determine the cost assigned to cost of goods sold and to the ending inventory. Specific identification will produce identical results under either a perpetual or a periodic inventory system.

2.2 Cost Flow Assumptions

Three Cost Flow Assumptions are used, discuss below both for perpetual inventory system and periodic inventory system:

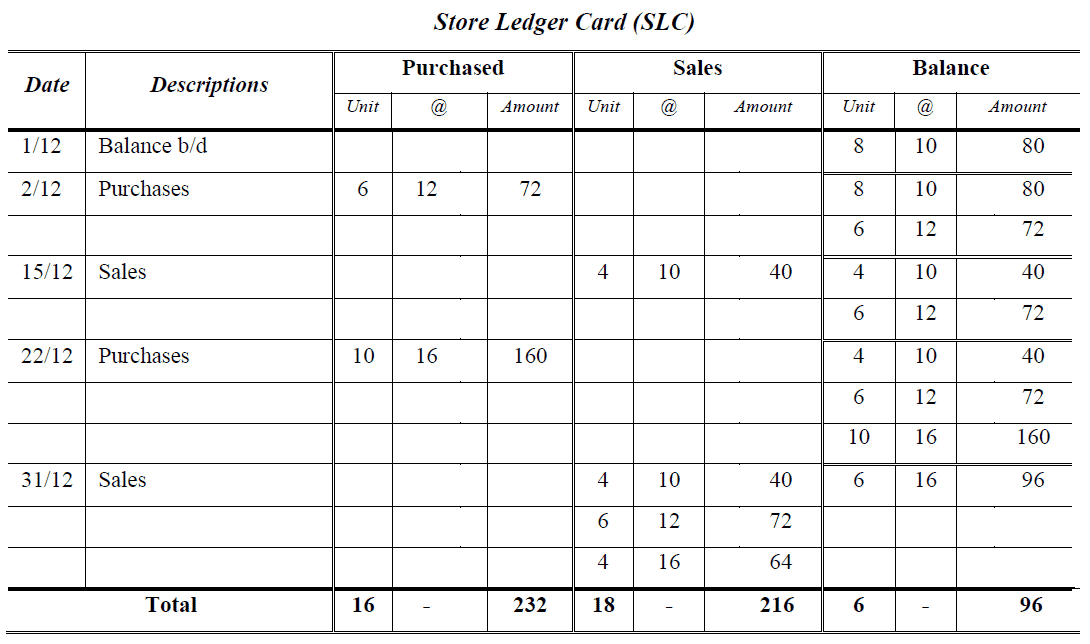

2.2.1 First in First Out (FIFO)

The first‑in, first‑out inventory costing method is based on the assumption that the first items received were the first items sold. In other words, items in the beginning inventory or the oldest items are assumed to be sold first. The most recent inventory purchased is assumed to remain in ending inventory.

>> Practice Inventory Valuation MCQs.

Example 1:

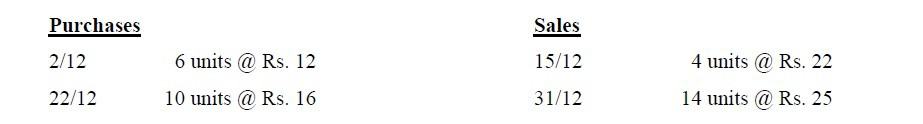

You are required to value the inventory by FIFO (Perpetual System). Opening Inventory is 8 Units at Rate of Rs. 10 at start of December and during the year the following were the purchases and sales of inventory:

Solution:

>> Further Reading Cost of Goods Sold.

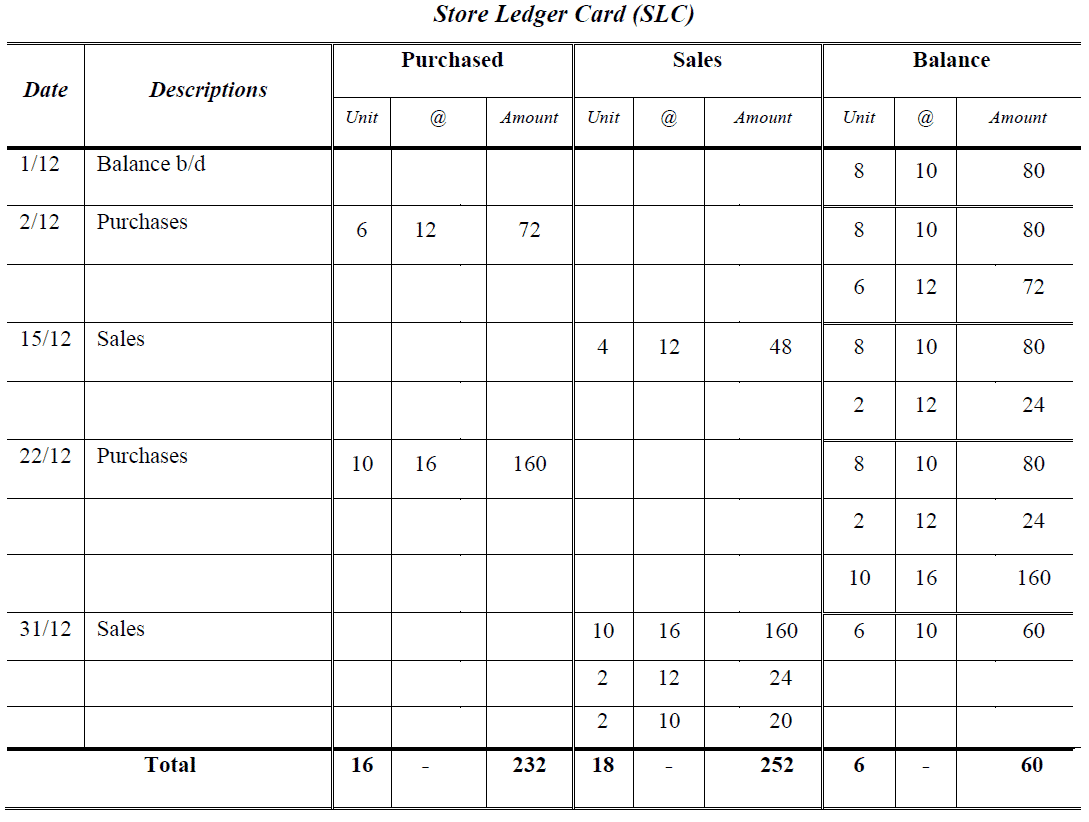

2.2.2 Last in First Out (LIFO)

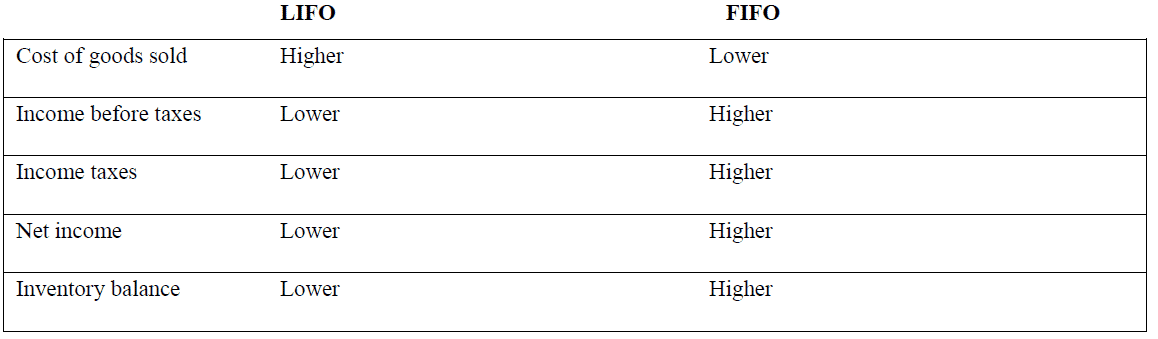

The last‑in, first‑out inventory costing method is based on the assumption that the last items received were the first items sold. In other words, the most recent purchases are assumed to be sold first and the old goods remain in inventory. However, the assumed flow of goods can differ from the actual physical flow. During inflationary times, recent costs are higher than old costs, resulting in higher cost of goods sold, lower net income, and lower income taxes.

Example 2:

You are required to value the inventory by LIFO (Perpetual System). Opening Inventory is 8 Units at Rate of Rs. 10 at start of December and during the year the following were the purchases and sales of inventory:

Solution:

>> Practice Inventory Valuation Problems and Solutions.

2.2.3 Average or Weighted Average

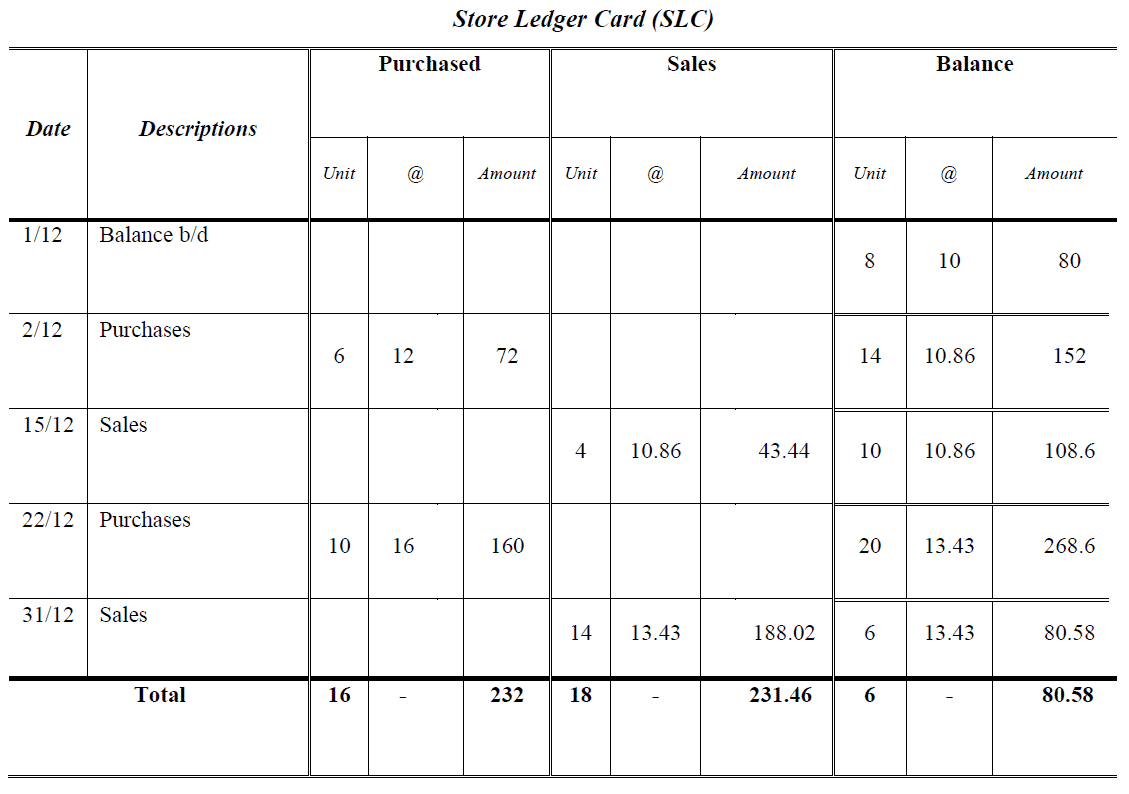

The weighted‑average inventory costing method uses a weighted‑average cost per inventory unit in assigning cost to units sold and to inventory. A weighted‑average is recalculated at the time of each purchase.

Example 3:

You are required to value the inventory by weighted average (Perpetual System). Opening Inventory is 8 Units at Rate of Rs. 10 at start of December and during the year the following were the purchases and sales of inventory:

Solution:

>> Practice Inventory Valuation Problems and Solutions.

Video Lecture: Costing Concepts in Urdu & Hindi-Workbook Practice

Click Here To Download Workbook Used in Video

Click Here To Download Workbook Used in Video

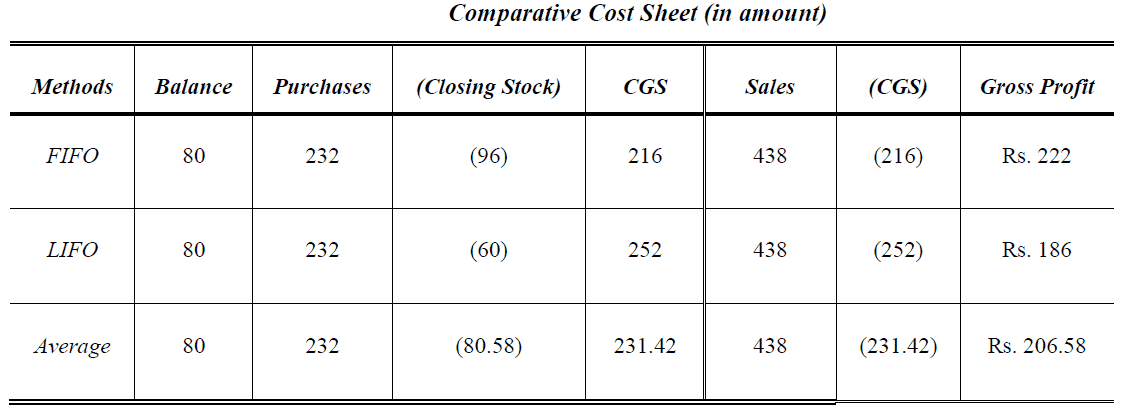

Results Variation in Inventory Valuation Methods

Each method is based on a different assumption about the cost of the merchandise that are sold and the cost of the merchandise that are left in ending inventory:

Impact of LIFO and FIFO in Periods of Rising Prices

Following are some impact on financial by using LIFO or FIFO:

>> Further Practice Inventory Management Problems and Solutions.

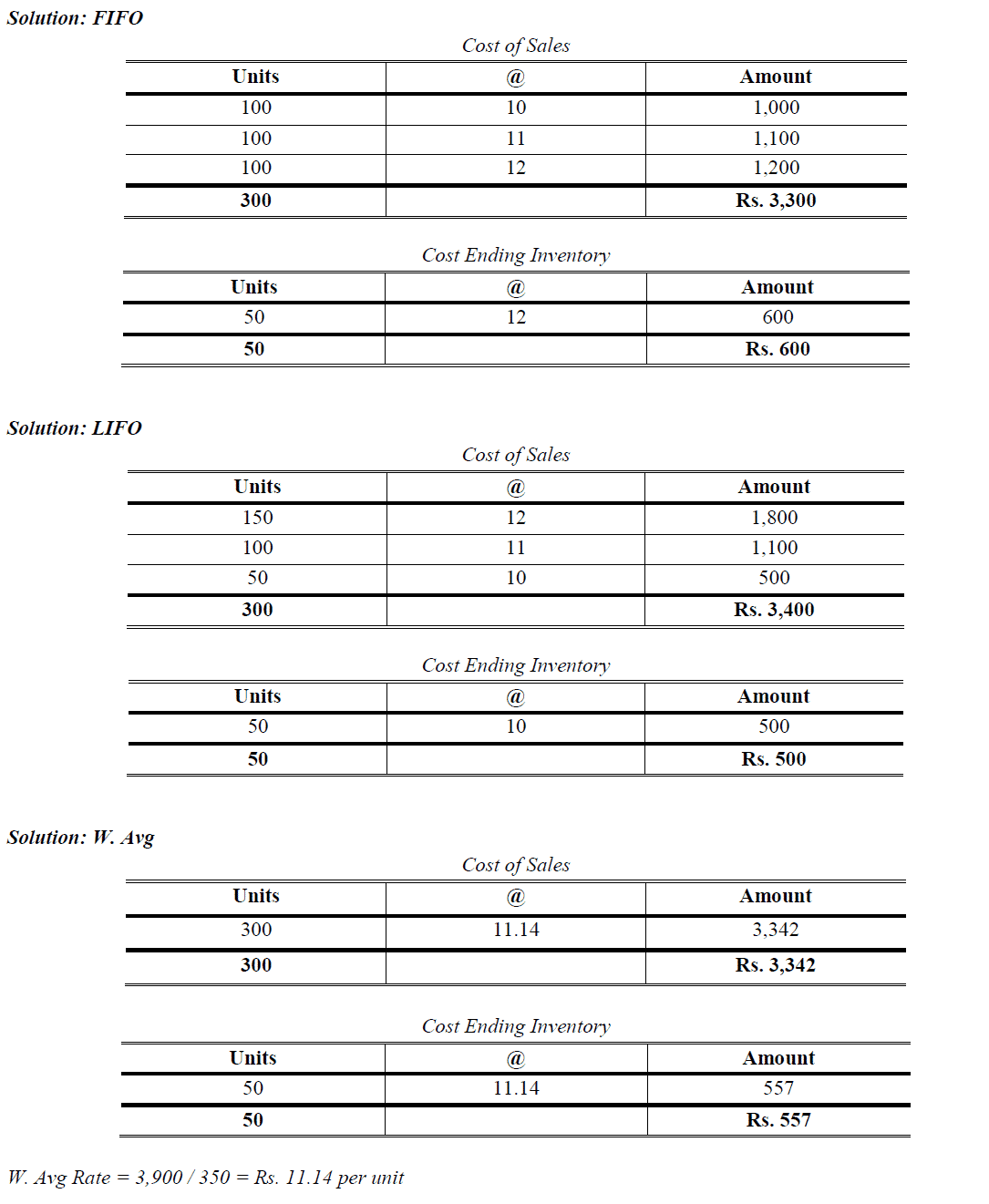

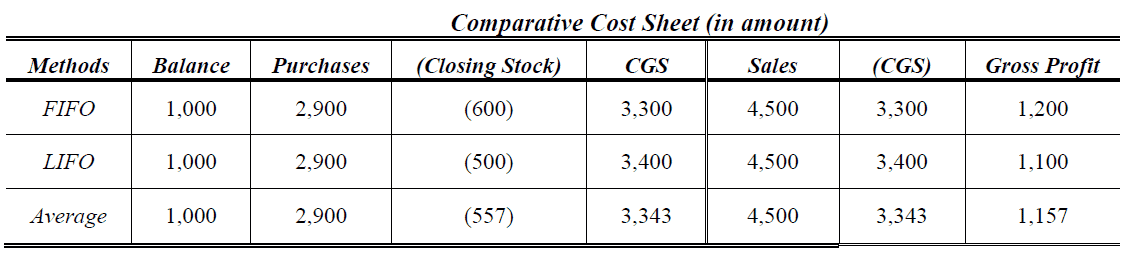

Cost flow Assumption under Periodic Inventory System

In physical inventory system stock taking are done at the end of period. No up-to-date record for cost of sales are available. In this type of problems issuing date are not mention.

>>> Practice Inventory Valuation Problems and Solutions.

Example 4:

You are required to value the inventory (Cost of Sales and Ending Inventory) by FIFO, LIFO and Weighted average (Periodic System) and Comparative Cost Sheet in amount:

Date Units @ Total

1 Jan Balance 100 @ 10 Rs. 1,000

5 Jan Purchases 100 @ 11 1,100

10 Jan Purchases 150 @ 12 1,800

During the period 300 unit were sold @ Rs. 15 per unit

Solution:

References

Mukharji, A., & Hanif, M. (2003). Financial Accounting (Vol. 1). New Delhi: Tata McGraw-Hill Publishing Co.

Narayanswami, R. (2008). Financial Accounting: A Managerial Perspective. (3rd, Ed.) New Delhi: Prentice Hall of India.

Ramchandran, N., & Kakani, R. K. (2007). Financial Accounting for Management. (2nd, Ed.) New Delhi: Tata McGraw Hill.

great work,appreciated