Costing

Previous Lesson: Cost Accounting

Next Lesson: Inventory Valuation

Cost and Expense

Cost is sacrifice of economic resources for example purchase of machinery, raw material etc.

Costs can be defined as money paid or spent to acquire an asset. It is mainly a one-time payment that is capitalized and reflected on a balance sheet.

Expense is expired cost that charged against revenue in particular accounting period say depreciation, rent etc.

The expense is an amount of money that must be spent especially regularly to pay for something. An expense is an ongoing payment, like rent, depreciation, salaries, and marketing.

The difference between cost and expense is that cost identifies an expenditure, while expense refers to the consumption of the item acquired. The key difference between expense vs expenditure is that expense refers to the amount spent by the business organization for the ongoing operations of the business in order to ensure the generation of the revenue, whereas, the expenditure refers to the amount spent by the business organization for the purpose of purchasing the fixed assets or reduce its liabilities or paid to owner.

Video Lecture: Costing Concepts in Urdu & Hindi-Workbook Practice

Click Here To Download Workbook Used in Video

Click Here To Download Workbook Used in Video

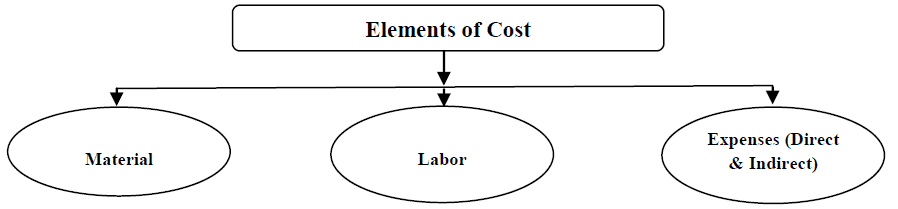

Elements of Manufacturing Costing

Cost of production/manufacturing consists of various expenses incurred on production/manufacturing of goods or services sold. These are the elements of cost which can be divided into three groups i.e. Material, Labor and Expenses.

1. Direct Material

Direct Material is that material which can be easily identified and related with specific product, job, and process. Timber is a raw material for making furniture, cloth for making garments, sugarcane for making sugar, and Gold/silver for making jewelry, etc. are some examples of direct material.

2. Direct Labor

Labor which takes active and direct part in the production of a product or providing services. Direct labor is that labor which can be easily identified and related with specific product, job and process. Direct labor cost is easily traceable to specific products. Direct labor varies directly with the volume of output. Cost of wages paid to carpenter for making furniture, cost of a tailor in producing readymade garments, cost of washer in dry cleaning unit are some examples of direct labor.

3. Expenses

All cost incurred in the production of finished goods other than material cost and labor cost are termed as expenses. Expenses are classified into two categories i.e. Direct expenses, and Indirect expenses (Factory Overheads).

3.1 Direct Expenses

These are expenses which are directly, easily, and wholly allocated to specific cost center or cost units and charged to direct material section. All direct cost other than direct material and direct labor are termed as direct expenses. Some examples of the direct expenses are cost of wages, inward carriage and freight, cost of patents, royalties etc.

3.2 Indirect Expenses

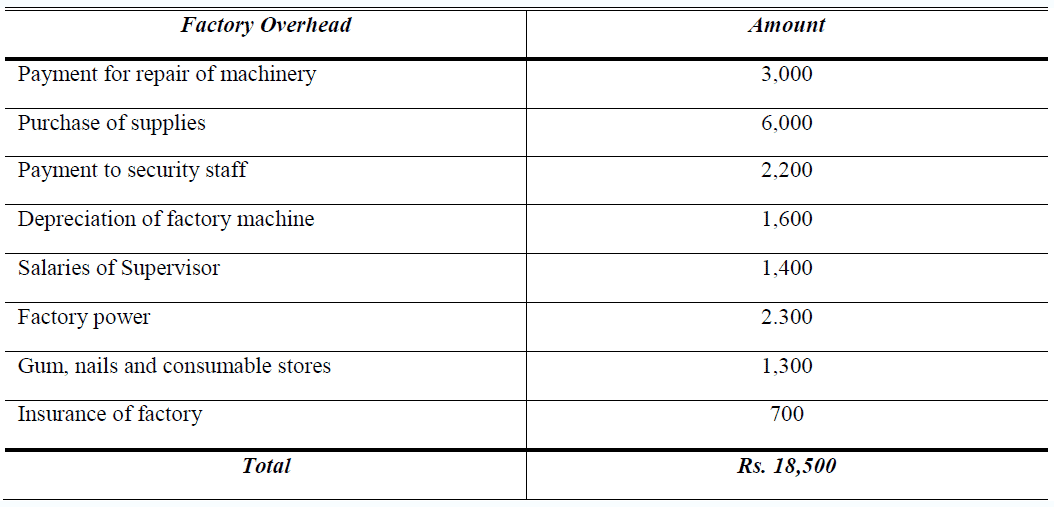

These expenses cannot be directly, easily, and wholly allocated to specific cost center or cost units. All indirect costs are indirect material, indirect labor and indirect expenses. Thus, indirect expenses are treated as part of Factory Overheads.

3.2.1 Indirect Materials

- Grease, oil, lubricants etc.

- Small tools, brushes for sweeping, sundry supplies etc.

- Gum, nails, consumable stores

- Factory printing and stationery

3.2.2 Indirect Labor

- Salary of factory manager, foremen, supervisors, clerks etc.

- Salary of storekeeper, security staff, time keepers

- Salary and fee of factory directors and technical directors

- Contribution to pension fund, leave pay etc. of factory employee

3.2.3 Indirect Expenses

- Rent of factory buildings and land

- Insurance of factory building, plant, and machinery

- Municipal taxes of factory building

- Depreciation of factory building, plant and machinery, and their repairs and maintenance charges

- Power and fuel used in factory

- Factory telephone expenses

>> Practice Costing Problems and Solutions.

Example # 1:

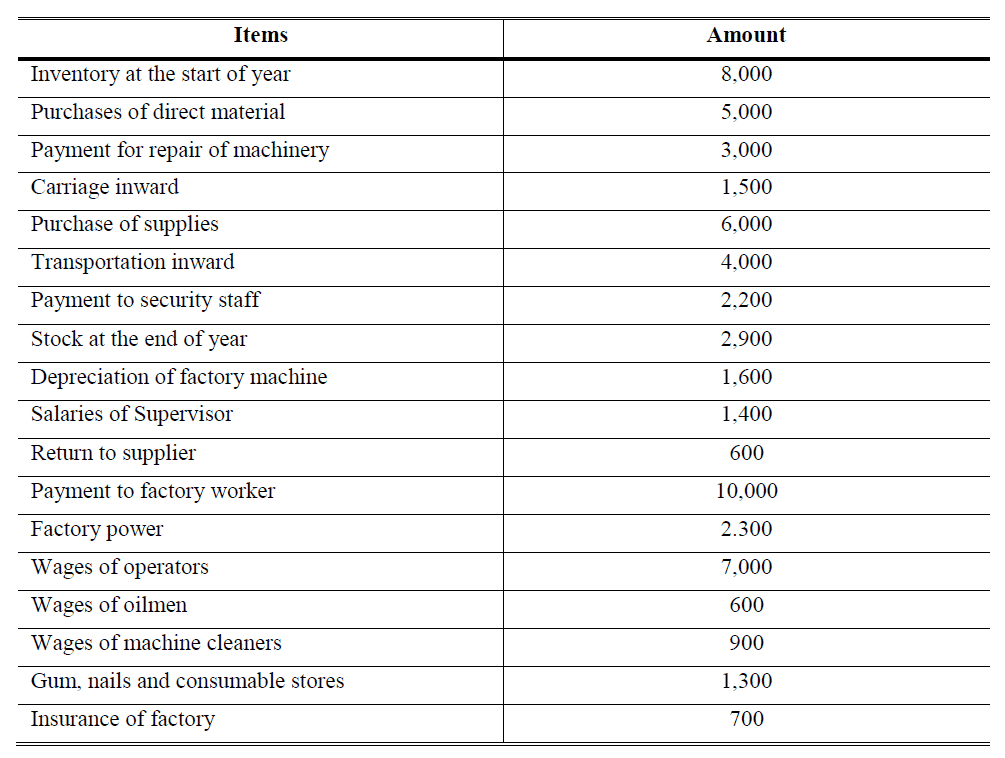

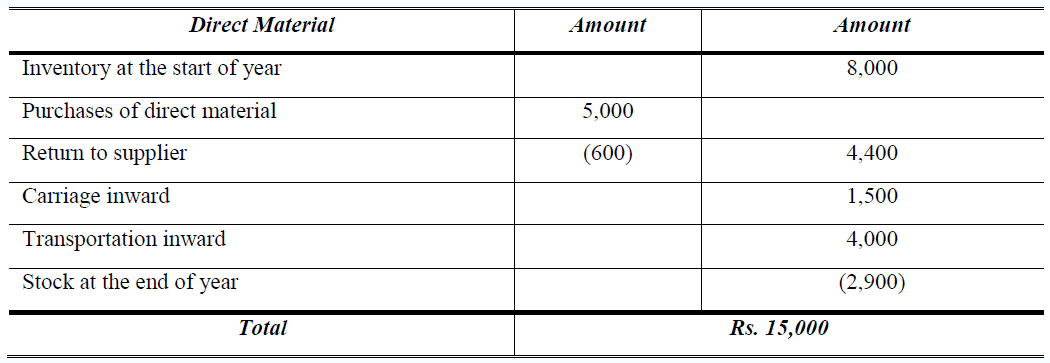

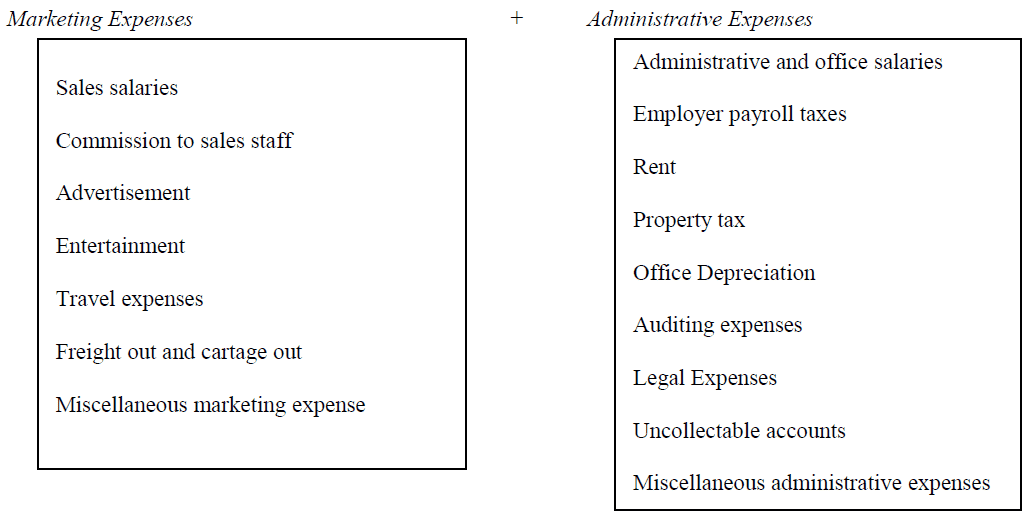

The following information has been taken from company records. You are required to calculate Direct Material, Direct Labor and Factory Overhead?

Solution:

>> Further Practice Cost of Goods Sold Problems and Solutions.

Cost of Sales

The term cost of sales use for merchandising or trading business. The cost of sales involves the identification of the expenses that are related to the trading process. Opening stock plus net purchases (with any direct expense) minus closing stock

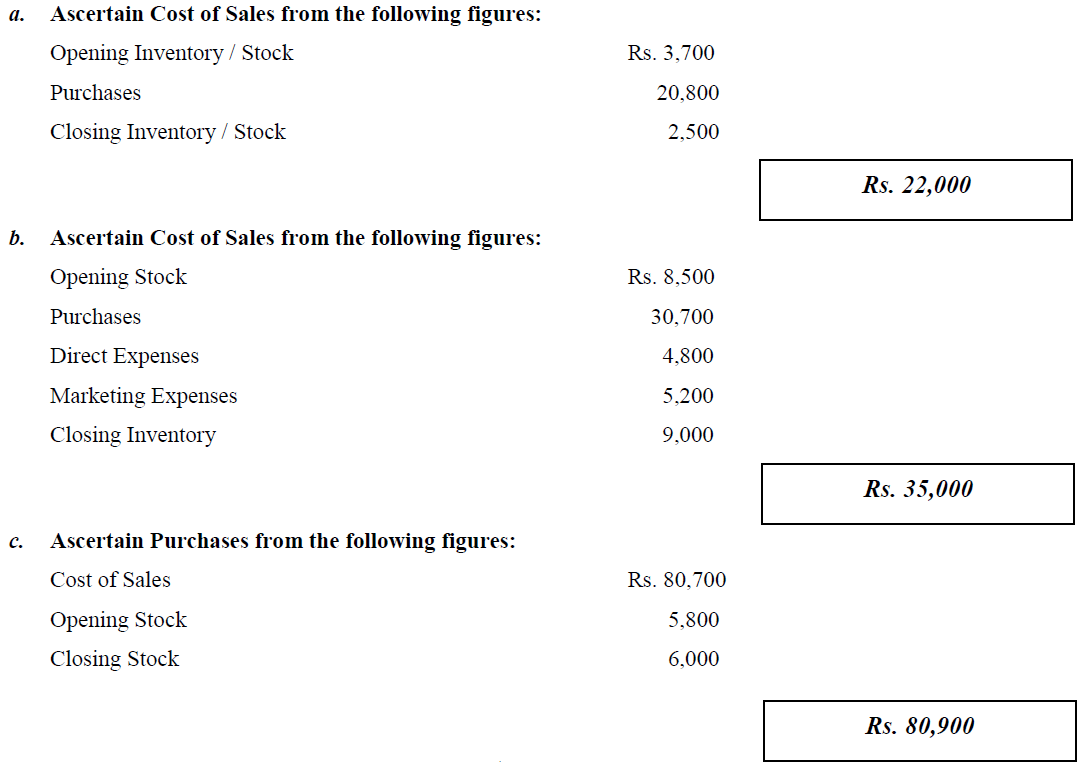

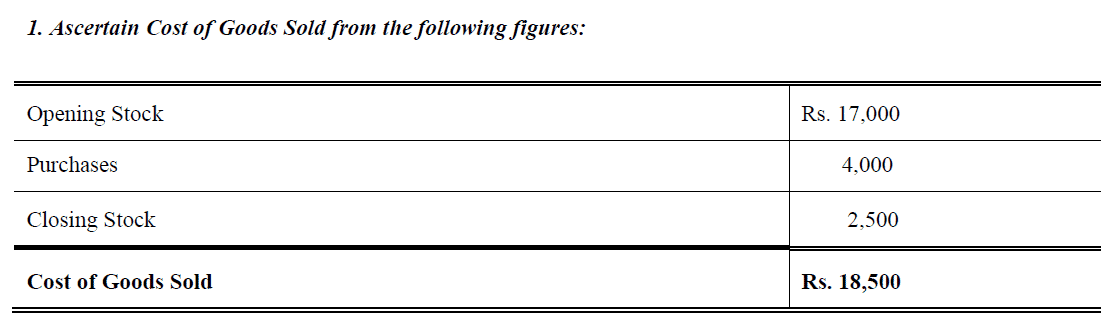

Example # 2:

Test your understanding?

>> Practice Costing Problems and Solutions.

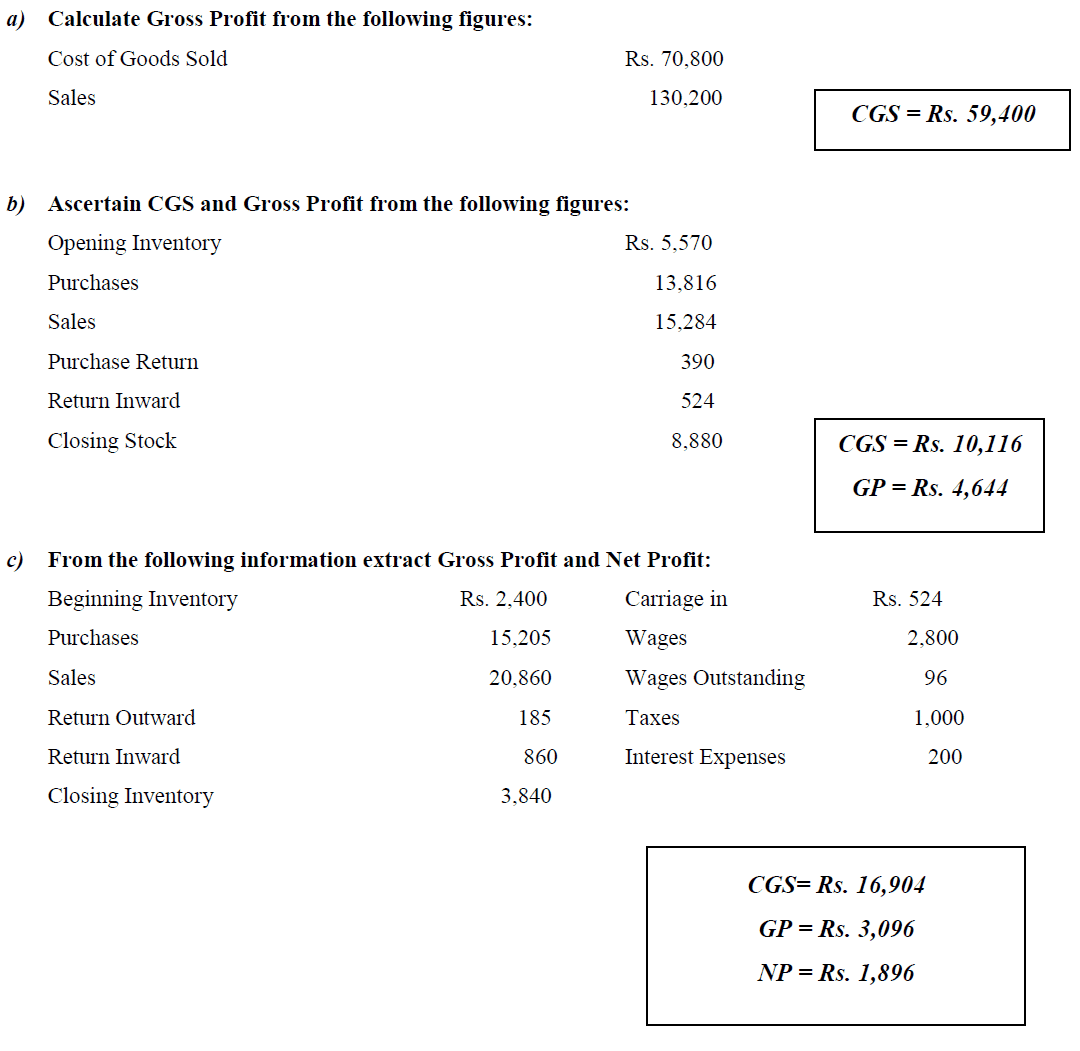

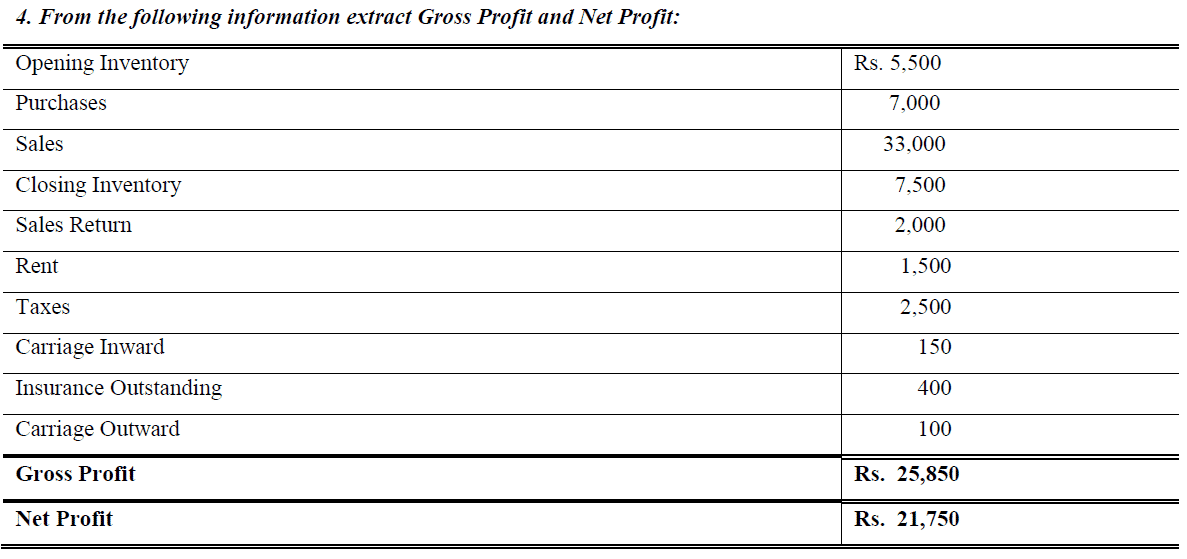

Gross Profit, Operating Profit and Net Profit

A company’s net revenue minus its cost of goods sold or cost of sales. Operating profit is gross profit minus commercial expenses of the company. Net profit is operating profit minus (financial charges, taxes and other expenses) plus other income.

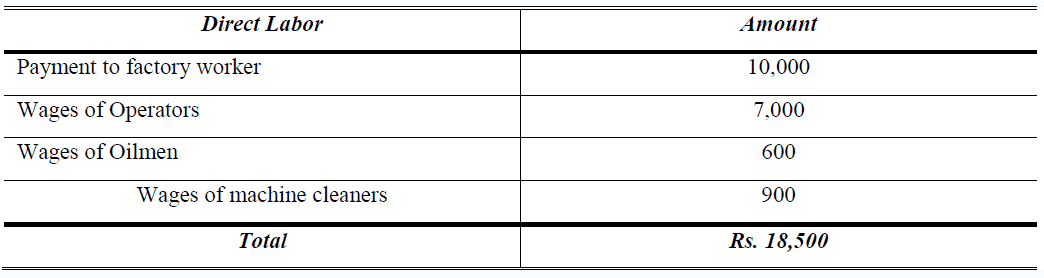

Commercial Expenses

Marketing expenses and administrative expenses are combine called commercial expenses. Following are some examples for commercial expenses

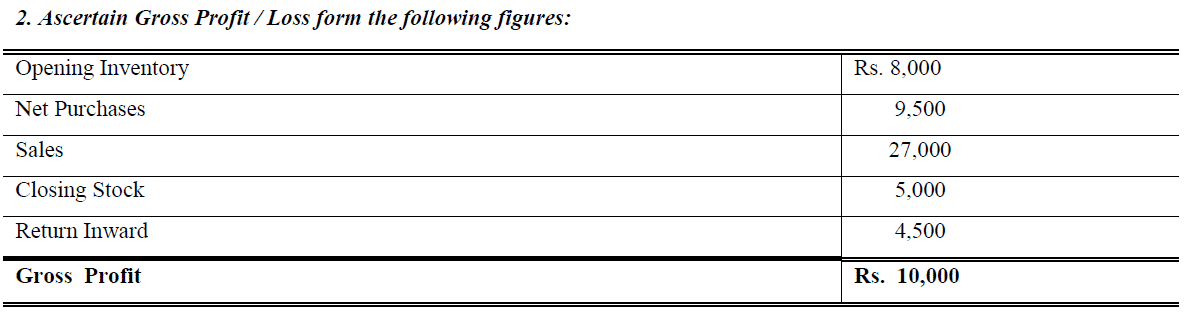

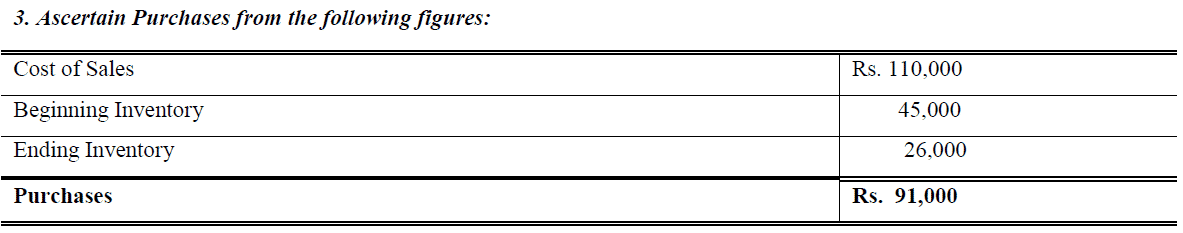

Example # 3:

Test your understanding?

>> Practice Costing MCQs.

References

Ramchandran, N., & Kakani, R. K. (2007). Financial Accounting for Management. (2nd, Ed.) New Delhi: Tata McGraw Hill.

Sehgal, A., & Sehgal, D. (n.d.). Advanced Accountancy (Vol. I & II). New Delhi: Taxmann Publication Pvt. Ltd.

Shukla, M. C., Grewal, T. S., & Gupta, S. C. (2008). Advanced Accountancy (Vol. I & II). New Delhi: S Chand & Co.

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2012). Accounting Principles (10th ed.). Hoboken: John Wiley & Sons, Inc.

Williams, M., & Bettner, H. (1999). Accounting (The basic for business decisions). (11th, Ed.) USA: Irwin McGraw- Hill.

0 Comments