Bank Reconciliation Statement

Previous Lesson: Petty Cash Book

Next Lesson: Bank Reconciliation Adjusted Balance Method

The bank and the company maintain independent records of the company’s checking account. The two balances are almost never same because of two reasons mentioned below:

- Time lags that prevent one of the parties from recording the transaction in the same period.

- Errors by either party in recording transactions. Bank errors are infrequent.

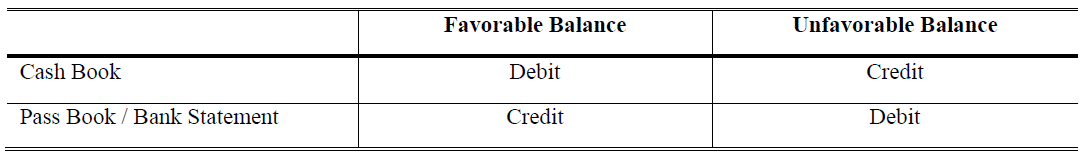

The Cash Book and pass book / bank statement are prepared separately. The Businessman prepares the cash book and the pass book is prepared by the Bank (here by cash book we mean two or Three Column Cash Book). But as both the books are related to one person and same transactions are recorded in both the books so the balance of both the books should match i.e. the balance as per pass book should match to balance at bank as per cash book.

But many a times these two balances do not agree then, it becomes necessary to reconcile them by preparing a statement which is called Bank Reconciliation. A Bank Reconciliation Statement may be defined as a statement showing the items of differences between the cash Book balance and the pass book balance, prepared on any day for reconciling the two balances.

A transaction relating to bank has to be recorded in both the books i.e. Cash Book and Pass Book. But sometimes it happens that a bank transaction is recorded only in one book and not recorded simultaneously. This causes difference in the two balances usually arises due to timing or errors.

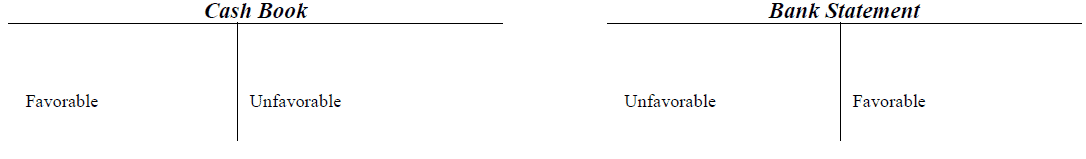

Bank Reconciliation Missing Approach

In missing method first of all we dig out missing or error items (Find Missing or Error Items). After that find the it is missing of cash book or bank statement (Find Missing Book). Finally, analyze that it is missing of debit or credit (Find Missing Side).

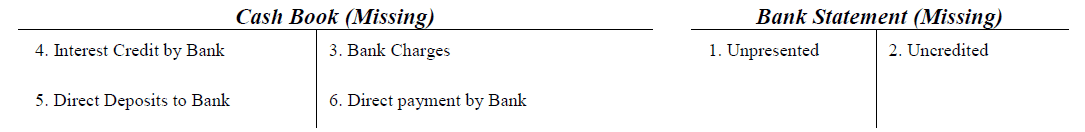

Unpresented / Outstanding / Not Cashed or Uncashed Cheques

Cheque issued (for payments) by business but not presented for payment. A cashier may send cheques out to suppliers, some of whom may present cheque at the bank immediately while others may keep the cheque for several days. Cashier will have recorded all the payments in the cash book immediately when issue the cheques. However, the bank records will only show the cheques that have actually been presented by the suppliers.

Uncredited / Uncollected / Uncleared or Outstation Cheques

Check deposited (for receipts) but not collected by bank. The firm’s cashier records a receipt in the cash book as he or she prepares the bank paying-in slip. However, the receipt may not be recorded by the bank on the bank statement for a day or so.

Bank Charges

The bank charges some amount from each customer by way of incidental charges, collection charges or interest on overdraft etc. Bank debited the amount in pass book. But customer comes to know about it only at the end of month.

Interest Credit by Bank

When the bank allows interest to a customer, it credits the customer’s account. But customer comes to know about it only at the end of month than he would pass appropriate entry.

Direct Deposits to Bank

When the bank has received a direct amount on the behalf of the business. Bank will have recorded the receipt in the business’s account at the bank but the business will be unaware.

Direct payment by Bank

Bank may have deducted items from the customer’s account, but the customer may not be aware of the deduction until the bank statement arrives. Examples of these deductions include are standing order and direct debit payments.

Check Dishonored

Cheque may be dishonored due to so many reasons. It is missing of cash book reverse impact as recorded before dishonored.

Errors and Omissions

Sometimes the difference between the two balances may be accounted for by an error or omission on the part of the bank statement or in the cash book of the business. Find the missing in order to rectify error or record omission

>> Understand and Practice Bank Reconciliation Statement Format.

Video Lecture: Costing Concepts in Urdu & Hindi-Workbook Practice

Click Here To Download Workbook Used in Video

Click Here To Download Workbook Used in Video

Bank Reconciliation Statement Examples

Example 1:

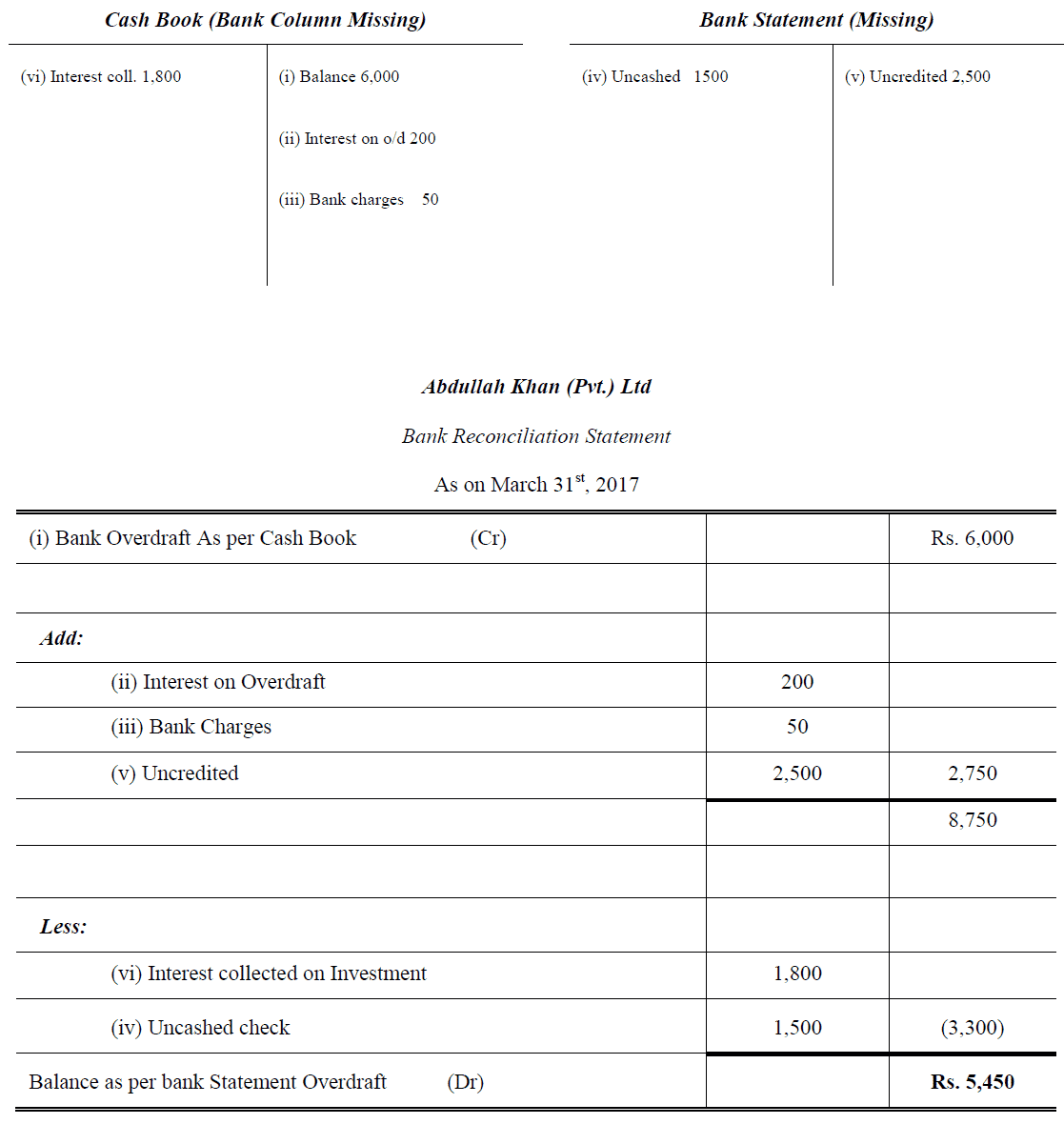

From the following particulars prepare a Bank Reconciliation Statement to find out the causes in two balances as on March 31st, 2017 for Abdullah Khan (Pvt.) Ltd:

(i) The bank overdraft as per cash book on March 31st, 2017 was Rs. 6,000

(ii) Interest on overdraft for six months ending March 31st, 2017 Rs. 200 is debited in the Bank Statement.

(iii) Bank charges for the above period also debited in the Bank Statement amounted to Rs. 50

(iv) Check issued, but not cashed, prior to 31.03.2017 amount to Rs. 1,500

(v) Check deposited into bank, but not cleared and credited before March 31st were for Rs. 2,500

(vi) Interest on investment collected by the bankers and credited in the Bank Statement amounted to Rs. 1,800.

Solution:

>>> Read and Practice Bank Reconciliation Statement Problems.

Example 2:

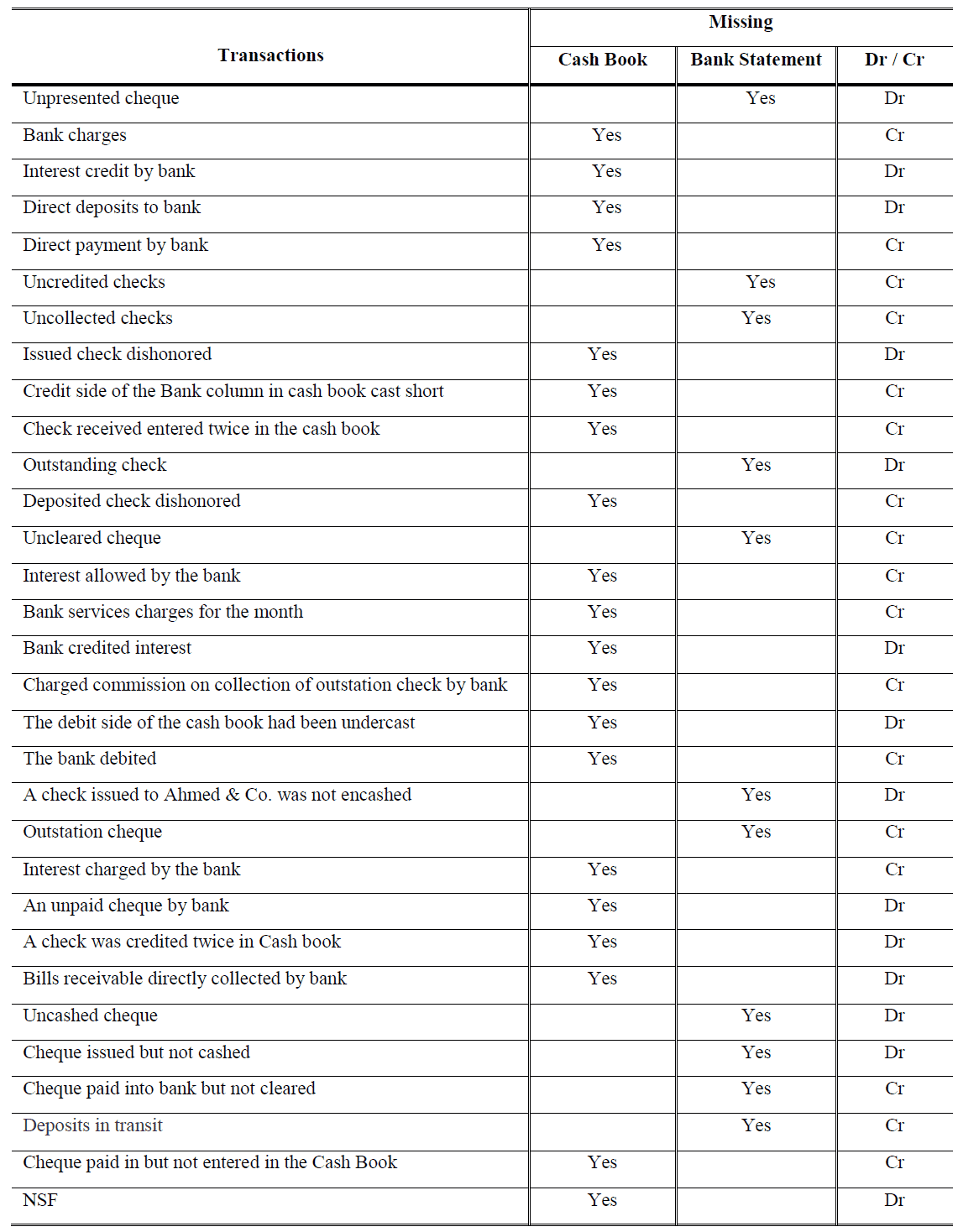

From the following transactions, you are required to mention missing (Cash Book or Bank Statement & Dr /Cr).

>>> Practice Bank Reconciliation Statement Quiz 1, Quiz 2, Quiz 3 and Quiz 4.

References

Mukharji, A., & Hanif, M. (2003). Financial Accounting (Vol. 1). New Delhi: Tata McGraw-Hill Publishing Co.

Narayanswami, R. (2008). Financial Accounting: A Managerial Perspective. (3rd, Ed.) New Delhi: Prentice Hall of India.

Ramchandran, N., & Kakani, R. K. (2007). Financial Accounting for Management. (2nd, Ed.) New Delhi: Tata McGraw Hill.

whoah this blog is magnificent i love studying your articles. Stay up the great work! You already know, many people are searching around for this info, you can aid them greatly.

This website help me to understand BRS in new style. Missing method is new one!!!!

Thanku for this knowledge sir…keep spreading the information always …

Satisfactory

Enjoyed examining this, very good stuff, thanks.

Thank you great zaheer swati

Respected sir

I like this style of bank reconciliation statement. L have never seen this missing method in books of accounting. This is your excellent contribution of BRS, which makes this topic very easy and understandable.

Easy method for solving bank reconciliation statement problems.

I could not resist commenting. Perfectly written!

Thank for the education i appreciate it very much.

Having read this I thought it was extremely informative. I appreciate you spending some time and effort to put this content together. I once again find myself spending a lot of time both reading and leaving comments. But so what, it was still worthwhile!

Thank you for sharing such a blog!

King regards,

Balle Cannon

Can u pls present the solution from to check the work I did

bank reconciliation statement with example 2019

It’s truly a nice and ᥙseful piece of information. I am ɡlad that you just shared this helpful informatіon with us.

Please stay us informed like this. Thank you for sharing.

EXLENT INFORMATION