Three Column Cash Book Problems and Solutions

Previous Lesson: Single Column Cash Book Problems

Next Lesson: Bank Reconciliation Statement Problems

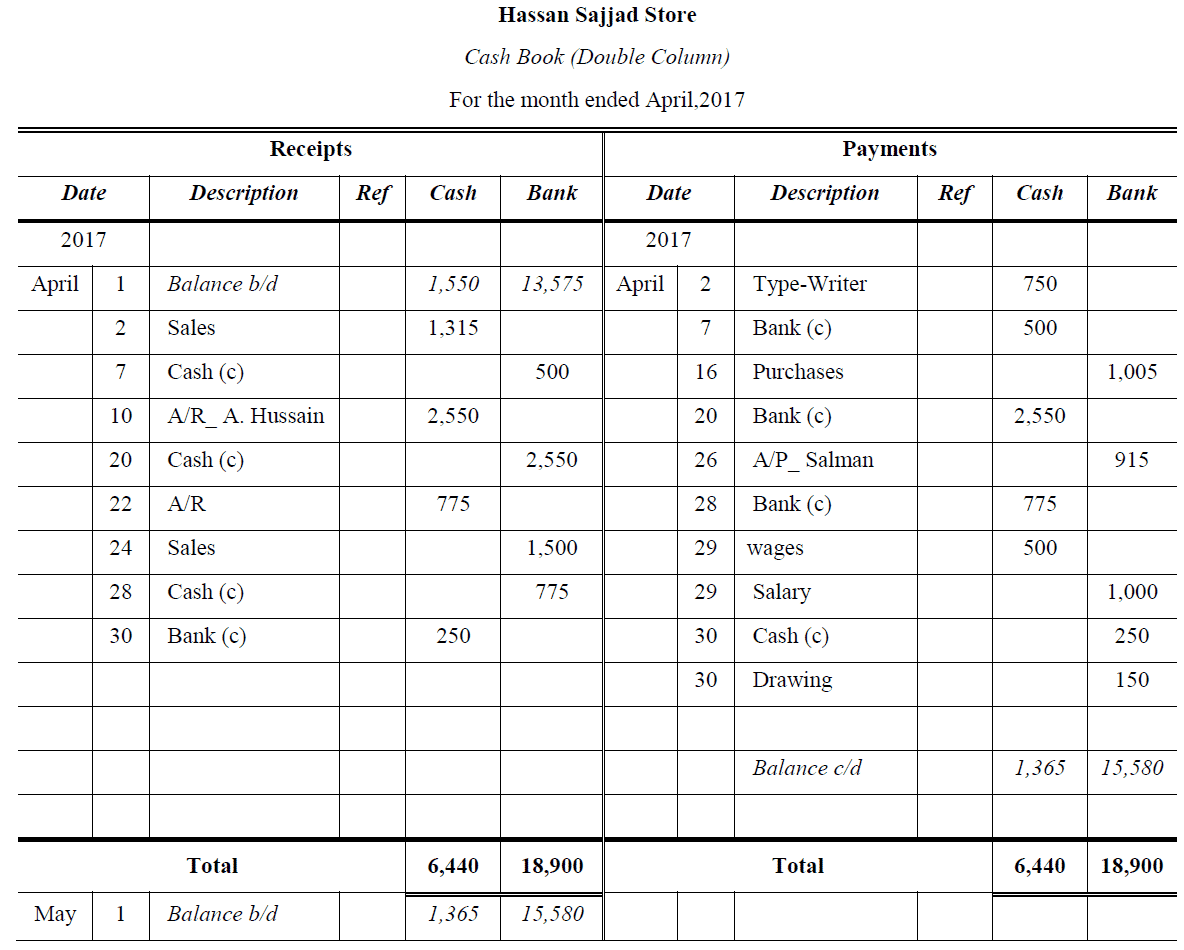

Problem 1:

On April 1, 2017, Hassan Sajjad Store Cash Book showed debit balances of Cash Rs. 1,550 and Bank Rs. 13,575. During the month of April following business was transacted. You are required to prepare Cash Book?

April 2017

02 Purchased Office Type-Writer for Cash Rs. 750; Cash Sales Rs. 1,315.

07 Deposited Cash Rs. 500 to bank.

10 Received from A. Hussain a check for Rs. 2,550 in part payment of his account (not deposited).

16 Paid by check for merchandise purchased worth Rs. 1,005.

20 Deposited into Bank the check received from A. Hussain.

22 Received from customer a check for Rs. 775 in full settlement of his accounts (not deposited).

24 Sold merchandise to sweet Bros. for Rs 1,500 who paid by check which was deposited into bank.

26 Paid creditor a Salman Rs. 915 by check.

28 Deposited into Bank the check of customer of worth Rs. 775 was dated 22nd April.

29 Paid wages by cash Rs. 500 and salary Rs. 1,000 by bank.

30 Drew from Bank for Office use Rs. 250 and Personal use Rs. 150.

Solution:

>> Use Three Column Cash Book Format for practicing Three Column Cash Book Problems and Solutions.

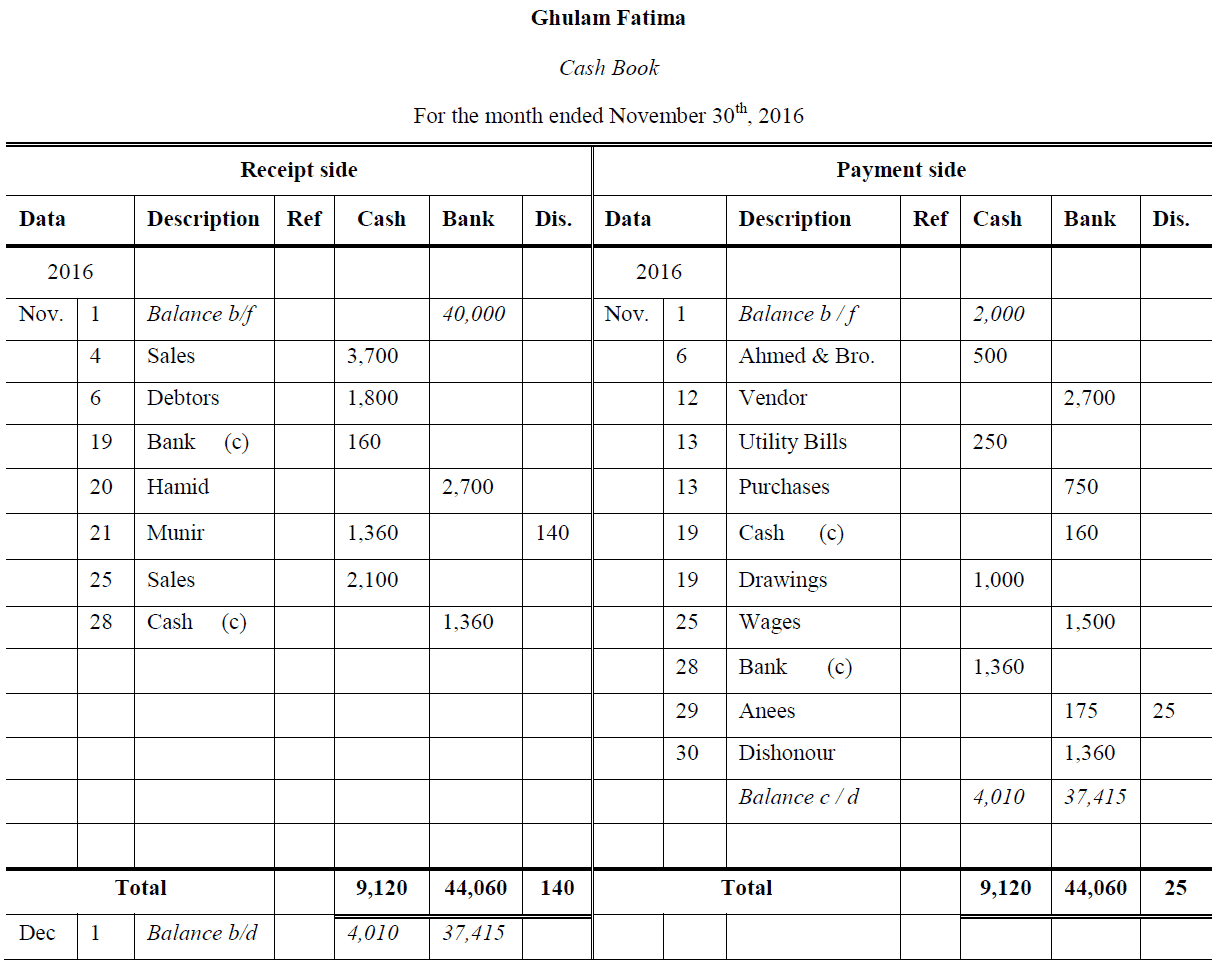

Problem 2:

From the following particulars make cash book of Ghulam Fatima Trading Co. for the month of November, 2016:

1 Cash balance (Cr) Rs. 2,000; Bank balance Rs. 40,000. 4 Cash sales Rs. 3,700; Credit sales Rs. 1,800 would be received at near future. 6 Paid Ahmed & Bros. by cash Rs. 500; Received cash by debtors Rs. 1,800. 12 Paid to vendor by means of check worth Rs. 2,700. 13 Paid Utility bills in cash Rs. 250; Bought goods by check Rs. 750. 19 Drew from Bank for office use Rs. 160; Personal withdrawal of cash Rs. 1,000. 20 Received a check from Hamid Rs. 2,700 and deposited into the bank. 21 Received by check from Munir Rs. 1,360; Discount Rs. 140 (not deposited). 25 Cash sales Rs. 2,100; Paid wages by bank Rs. 1,500. 28 Deposited Munir’s check into bank. 29 Payment by check to Anees for Rs. 175; Discount received Rs. 25. 30 Munir’s check has been dishonored and return by bank.

Solution:

>> Read Three Column Cash Book theory related issues and questions.

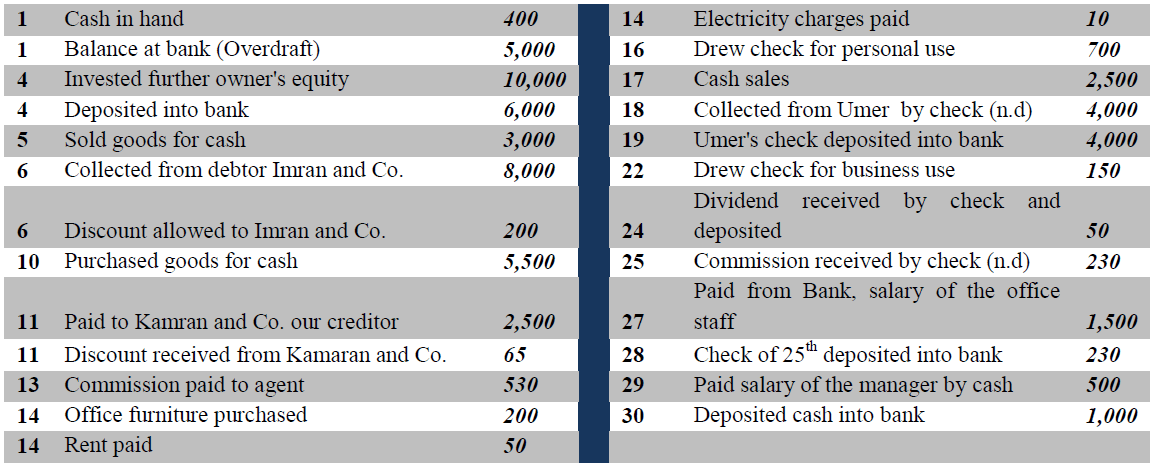

Problem 3:

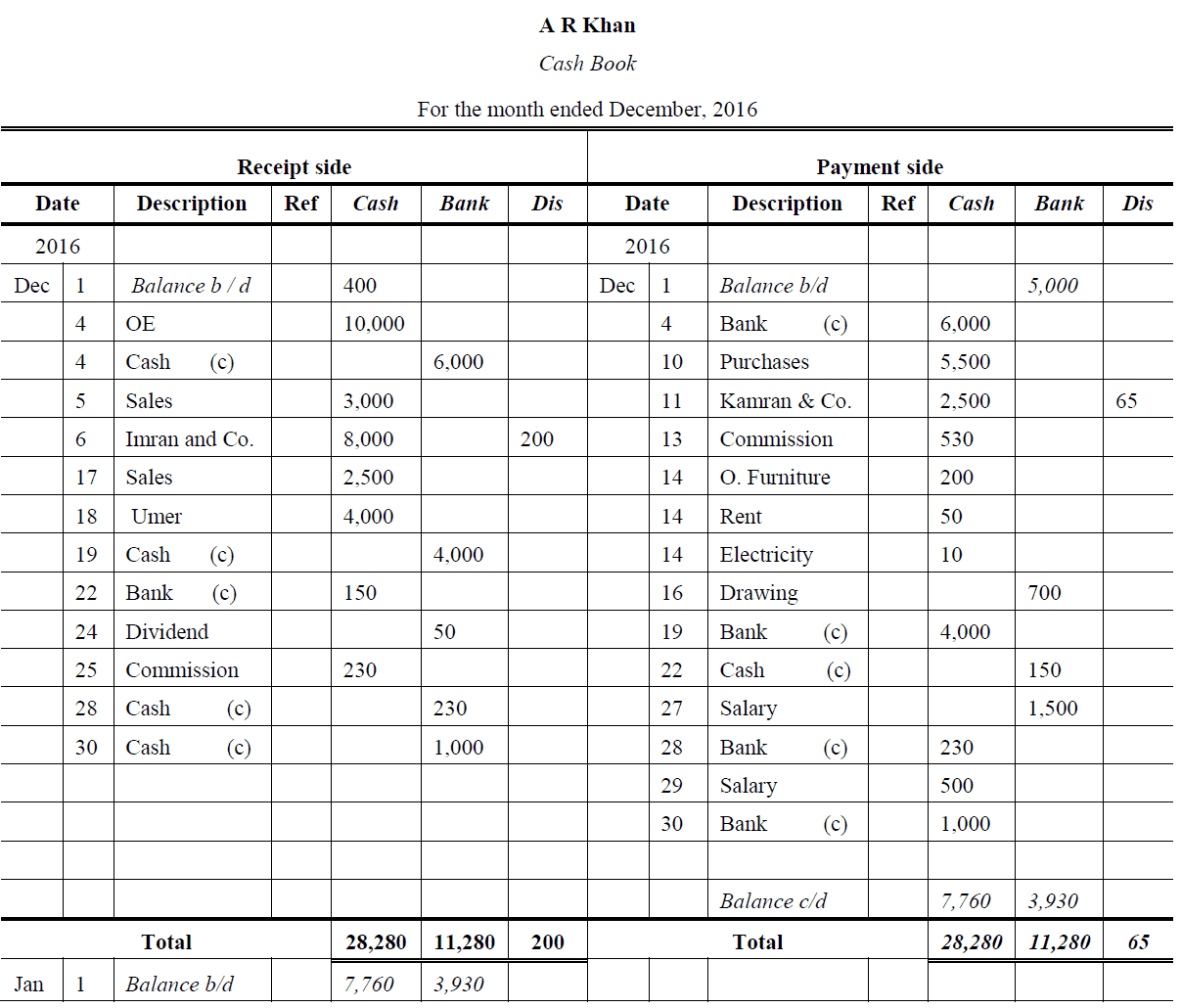

Enter the following transactions in the Cash Book with Cash, Bank and Discount column for A R Khan and Co. for December, 2016 (all figures in Rupees):

Solution:

>> Do Practice Cash book MCQs for conceptual and theoretical understanding.

Problem 4:

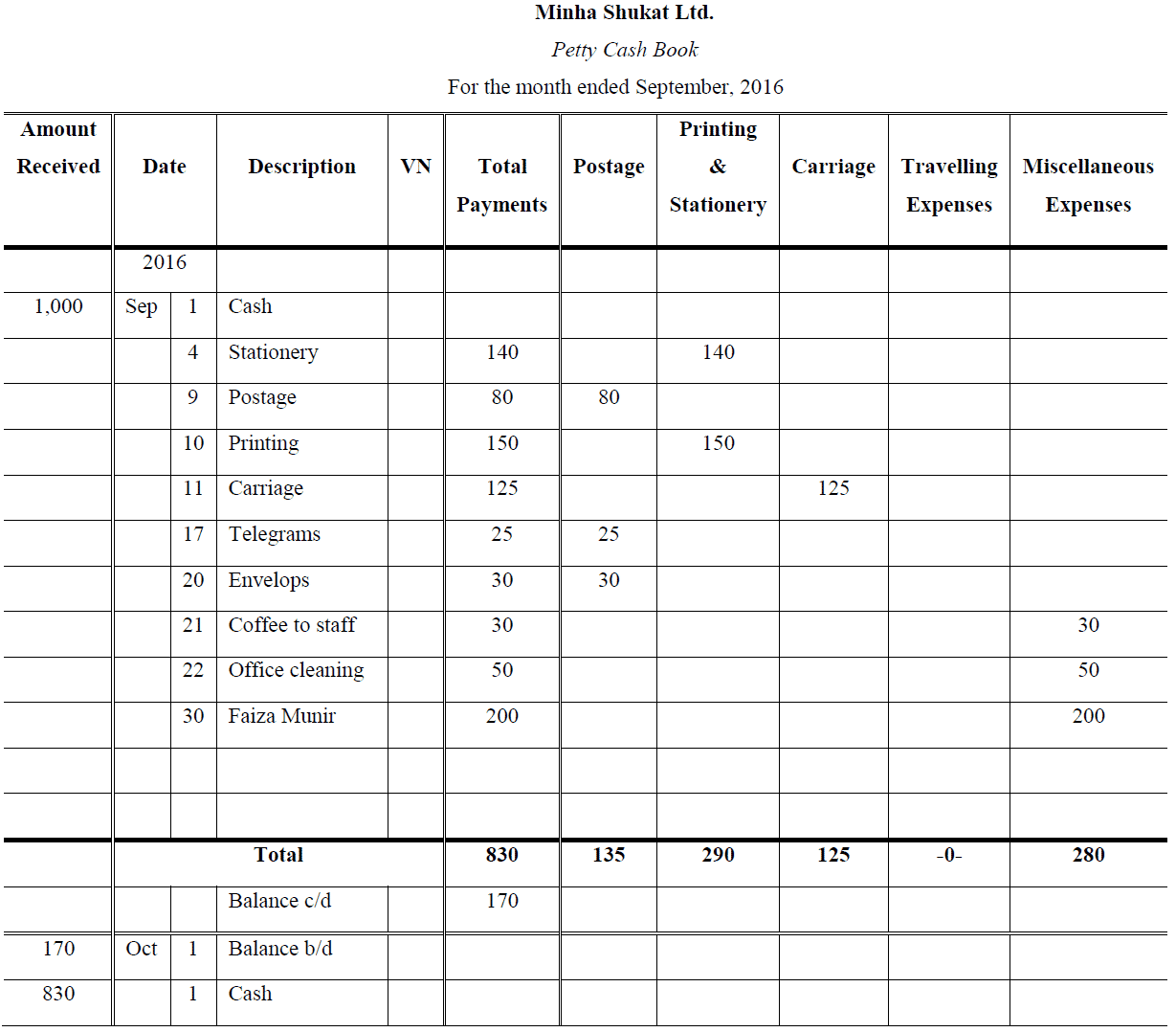

Prepare Petty Cash Book on imprest system from the following particulars for Minha Shukat Ltd.

September 2016

1. Received for petty cash payments Rs. 1,000

4. Paid for stationery Rs. 140

9. Paid for postage Rs. 80

10. Paid for printing charges Rs. 150

11. Paid for carriage Rs. 125

17. Paid for telegrams Rs. 25

20. Purchased envelops Rs. 30

21. Paid for coffee to office staff Rs. 30

22. Paid for office cleaning Rs. 50

30. Paid to Faiza Munir Rs. 200

Solution:

>> Read More Petty Cash Book.

Related Questions

Two Column Cash Book

Three Column Cash Book Examples

Related Problems

Three Column Cash Book Questions

Three Column Cash Book Exam Questions

Three Column Cash Books Exercises

References

Ramchandran, N., & Kakani, R. K. (2007). Financial Accounting for Management. (2nd, Ed.) New Delhi: Tata McGraw Hill.

Sehgal, A., & Sehgal, D. (n.d.). Advanced Accountancy (Vol. I & II). New Delhi: Taxmann Publication Pvt. Ltd.

Shukla, M. C., Grewal, T. S., & Gupta, S. C. (2008). Advanced Accountancy (Vol. I & II). New Delhi: S Chand & Co.

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2012). Accounting Principles (10th ed.). Hoboken: John Wiley & Sons, Inc.

Williams, M., & Bettner, H. (1999). Accounting (The basic for business decisions). (11th, Ed.) USA: Irwin McGraw- Hill.

I’m every happy the accounting department of education

What if you are told Received Ksh 45000 from Bado Traders in full settlement of his account….

How do we treat it

Since we have not been told by cheque or cash

we assume cash

Please Sir add my number WhatsApp group for accounting 09036102497

Best view i have ever seen !

I’m so much pleased with you’re work done pliz if you will not mine send me these to my email

what if the cash on the receipt side is more than that on the payment side but the bank on the payment side is more than that on the receipt side

It is Simple situation, Cash will be debit balance means cash in hand and Bank has overdraft balance.

Love this page

Are credit sales recorded on cash book??

No.

Yes

no should recorded in the debtors account so you Dr debtors then you credit sales

Any credit sale must not be recorded in cash book but in credit sale day book .

CommentServe us with solutions

Thanks I’m impressed it really helped me

Banked cash , how to record them in three column cash book

Paid to doris 800 cash less 3%, how to calculate and record in three column cash book

Thanks for your work. I always understand it better because it is well explained and simplied. But what about if the say our cheque to John was dishonored will you record it in a cash book?

500

Is contra

You will

debit it and at the same time credit it

thank you very much its helps me a lot

thank you very much its helps me a lot

What if things were sold at credit, which account will be debited. Like:

sold good to Mr.A on credit worth 14,000

What would be the entries?

Awesome! Its actually awesome paragraph, I have got much clear idea on the topic of from these problems and solutions set.

Yes nice

Let solutions be sent to my accouant than you

Thanks for sharing

Hey there,

I recognized that the solution2017

April 10 : Cash receive from Husain by check(Cheque) was recorded in cash column. Is thuan correct or wrong? Please update!

Thank you..

If check received and retained in business, will recorded as a cash in cash book, otherwise, if check received and deposited into bank than recorded in debit side in bank column.

Yeah, mam its absolutely correct to enter in bank column but only it applies when the recived cheque is debited on same day /but we recieve the cheque on 10april and deposited on subsequent day so it is considered as cash balance

7995754334

I need a well compreshesived solve question on 3 column cash book.Errors that affect the agreement to the trial balance and questions and problems solved.i will be very greatful.Thanks

Am very much greatful for the work you are doing here.please,can these problems solved be sent to my Email.i will be very greatful

Helpful for me

Pls, I think there is an error in problem 2.

Number 21.

Kindly check pls.

Verynice