Internal Rate of Return

Previous Lesson: Profitability Index

Next Course: Financial Statement Analysis

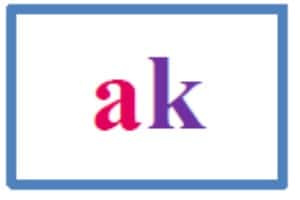

The Internal Rate of Return of a project is the discount rate which makes it NPV to zero. The IRR is compared with RRR or cost of capital. If the IRR exceeds the required return, the project is accepted; if not the project is rejected:

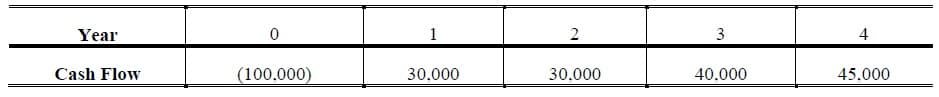

Example 1:

Consider the following cash flows and calculate IRR.

Related Topics

Capital Budgeting Problems

Further Readings

References

Financial Management: Theory and Practice, Dr Eugene F Brigham & C Micheal Ehrhardt

Fundamentals of Financial Management: Concise Edition, Brigham Houston

The Economist Guide to Financial Management, John Tennet

Financial Management: Core Concepts, Raymond M Brooks

Super notes