Future Value of Annuity

Previous Lesson: Present Value of a Single Amount

Next Lesson: Present Value of Annuity

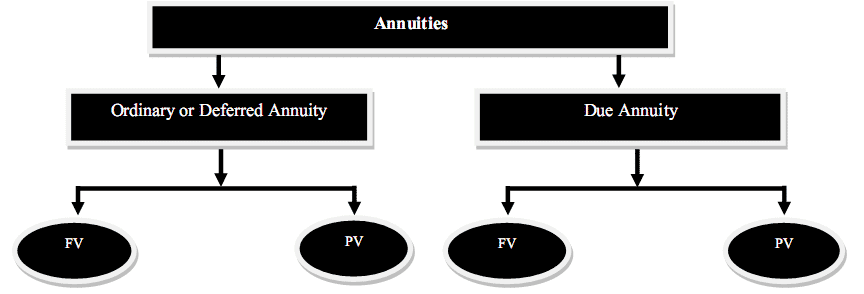

Future Value of Annuity is a series of constant cash flows (CCF) over limited period time i.e. monthly rent, installment payments, lease rental. When a sequence of payments of some fixed amount are made in an account at equal intervals of time. There are two types of ordinary annuity:

Ordinary Annuity or Deferred Annuity

If constant cash flow occur at the end of each period/year. Payment of car loan, mortgage loan and student loan are examples of ordinary annuity

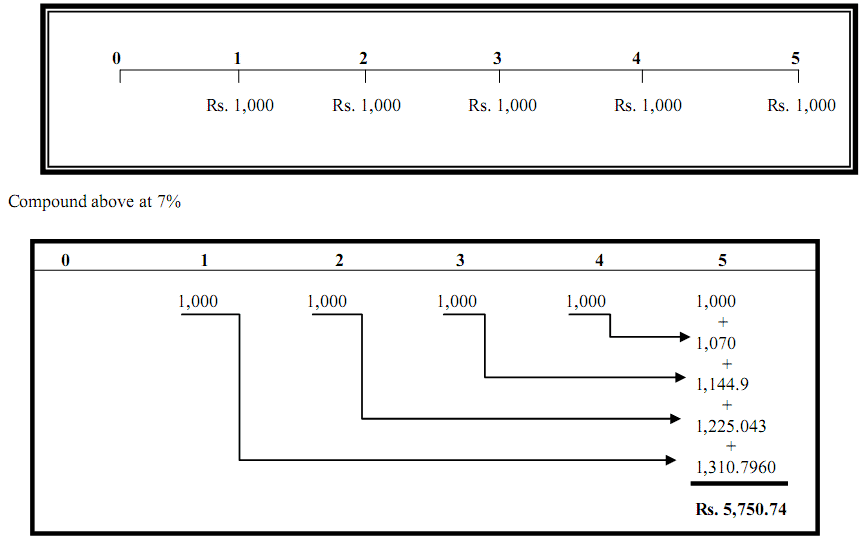

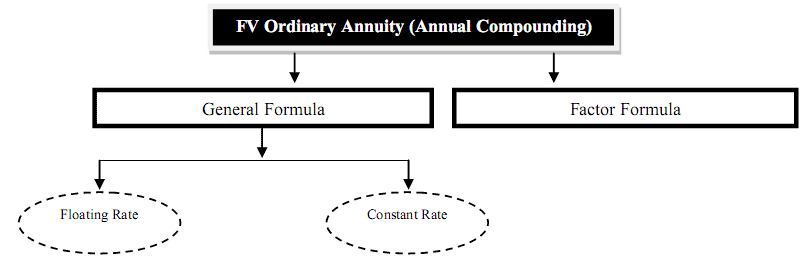

Future value of ordinary annuity (annual compounding)

The value of annuity at some future time evaluated at a given interest rate assuming that compounding take place one time in a year (Annually). Two methods for calculation:

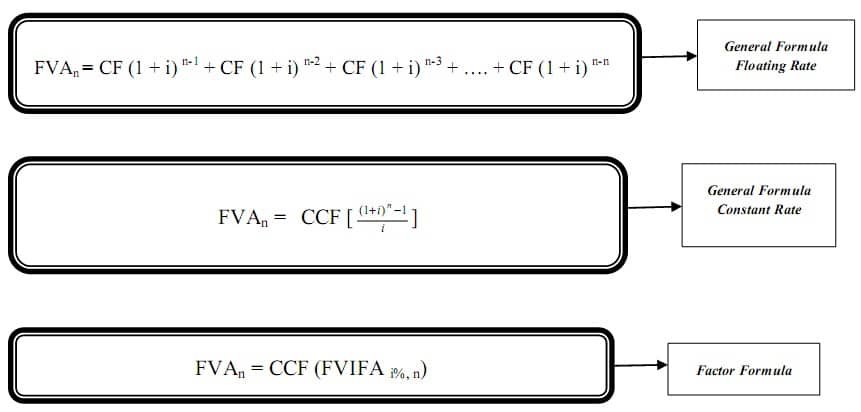

Formula

FVAn = Future value of ordinary annuity for n years

FVIFA = Future Value Interest Factor for Annuity

CCF = Constant Cash Flows

i = Interest rate

n = Number of years

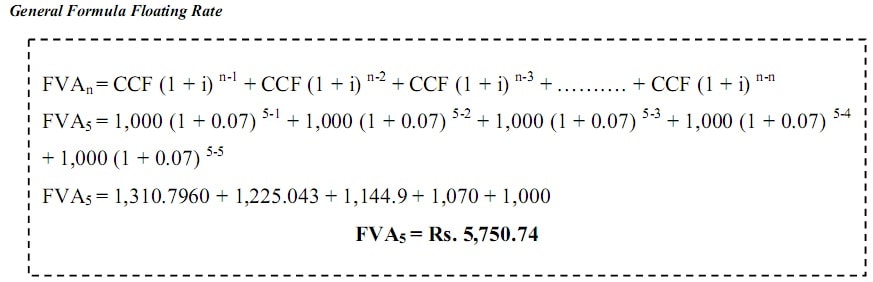

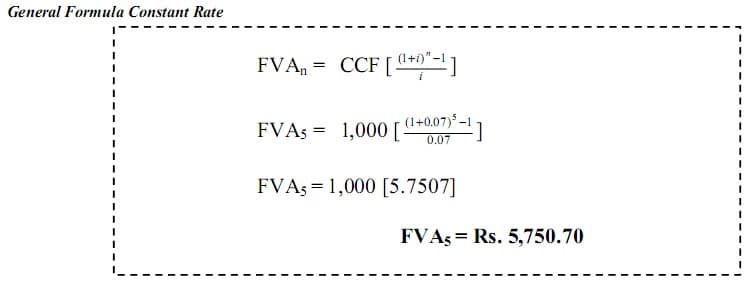

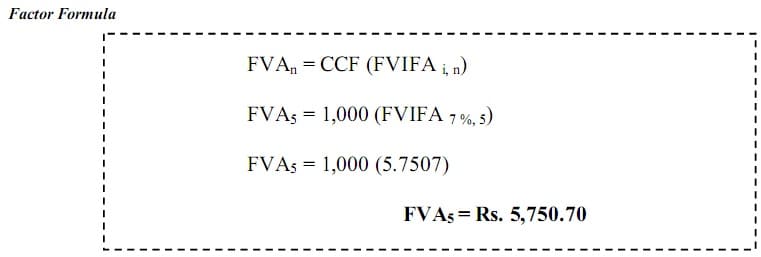

Example # 1:

If an employee deposits Rs. 1,000 at the end of each year into his company’s plan which pays 7% interest compounded yearly, how much will he have in the account at the end of 5 years?

Future Value of Annuity Table Download

Example # 2:

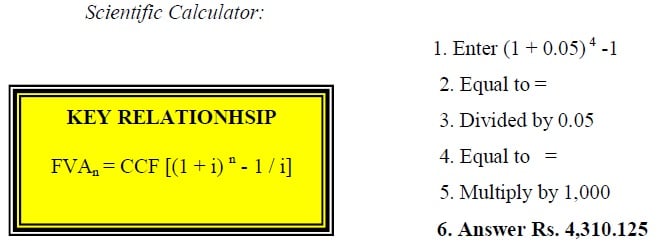

What is the future value of a 4-year annuity, if the annual interest is 5%, and the annual payment is Rs. 1,000; calculate by scientific calculator and by spread sheet?

Example # 3:

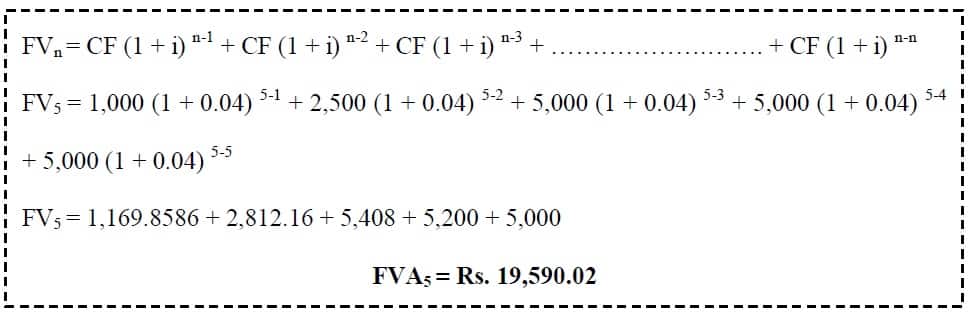

What is the future value of income stream which provides Rs. 1,000 at the end of year one, Rs. 2,500 at the end of year two, and Rs. 5,000 during each of the year 3 through 5, if the discount rate is 4 percent?

>> Practice Future Value of Annuity MCQs.

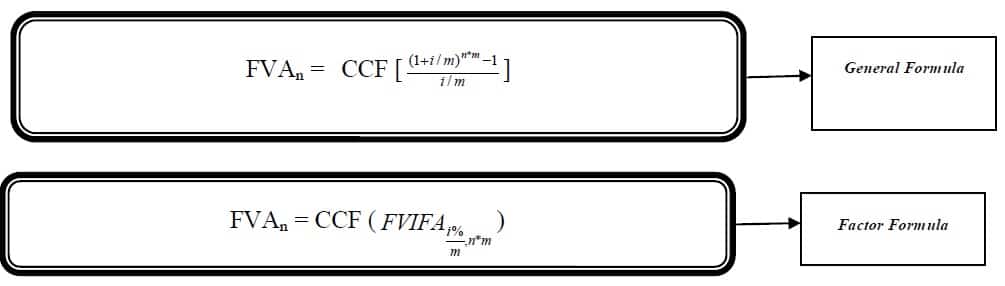

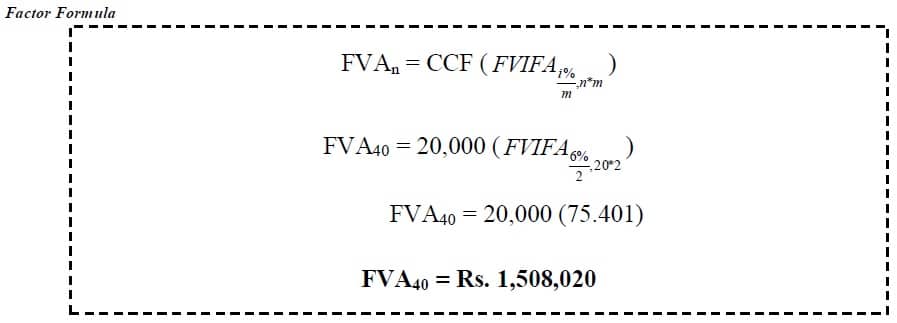

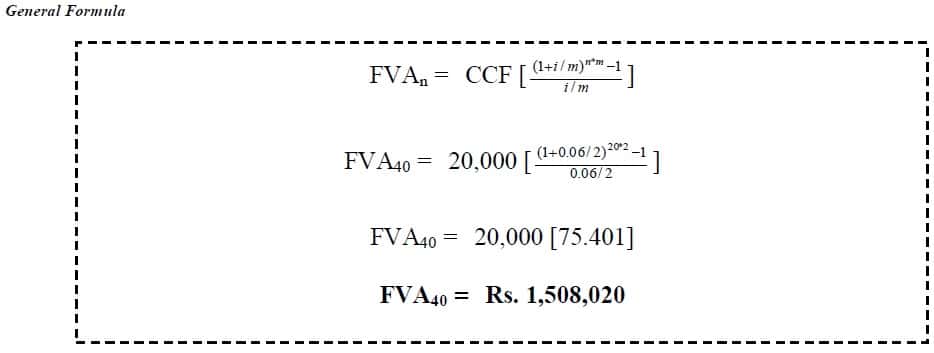

Future value of annuity (intra-year compounding)

The value of annuity at some future time evaluated at a given interest rate assuming that compounding take place more than one time in a year (Intra-year). Interest rate reduced while periods of time increase by frequency of compounding (m) i.e. i/m and n*m. Two methods for calculation:

Formula

Time Value of Money Formula Sheet Download

Example # 4:

Mohammad Ali Corporation started making sinking fund deposits of Rs. 20,000 at end of year. Its bank pays 6% compounded semi-annually. What will the fund be worth at the end of that time by factor formula and general formula?

Future Value of Annuity Table Download

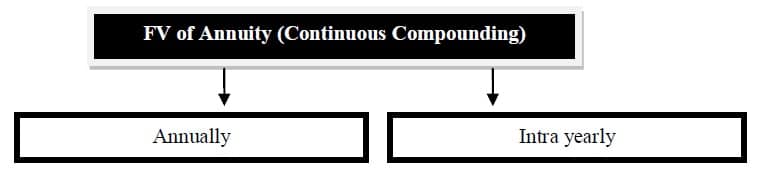

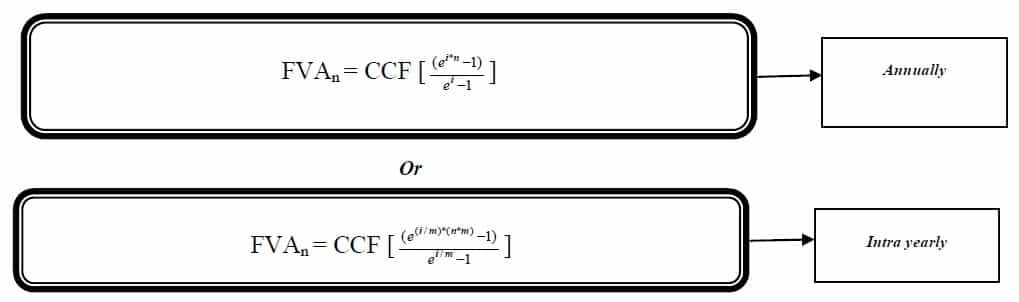

Future value of annuity by continuous compounding

When interest is compounded “many times”, we say that the interest is compounded continuously. It can be done annually or intra yearly (No matter it is annually or intra yearly, answer will be same for all).

Formula

Time Value of Money Formula Sheet Download

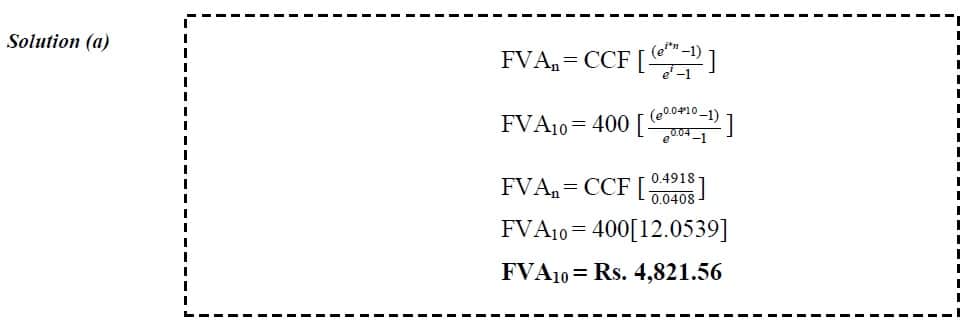

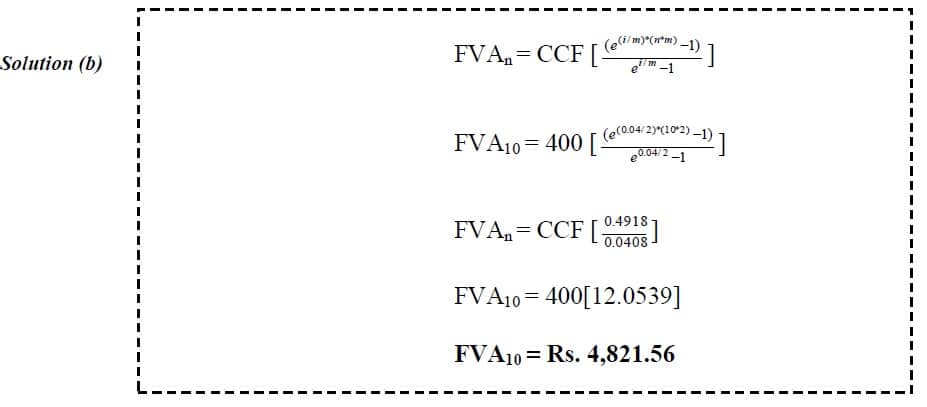

Example # 5:

Ten annual payments of Rs. 400 are made into a national bank deposit account that pays 4 percent interest per year. What is the future value of this annuity at the end of 10th years if continuous compounding takes place

(a) Annually

(b) Semi annually?

>> Practice Future Value of Annuity MCQs.

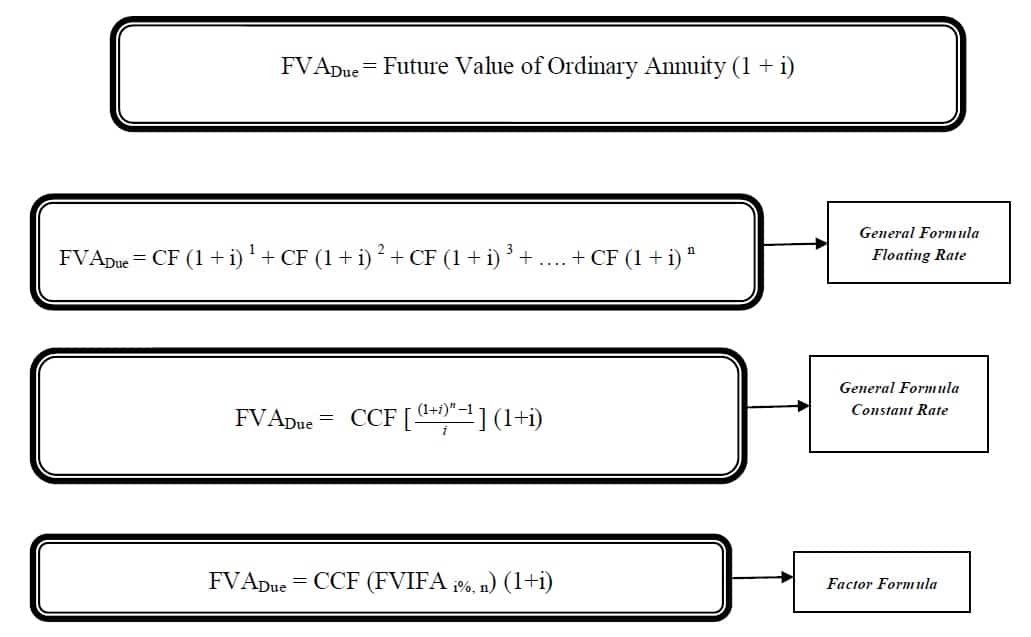

Annuity Due

If payments or receipts are made at the beginning of each year/period, the annuity is an annuity due. Rental payment for apartment and life insurance payments are typical example of this annuity

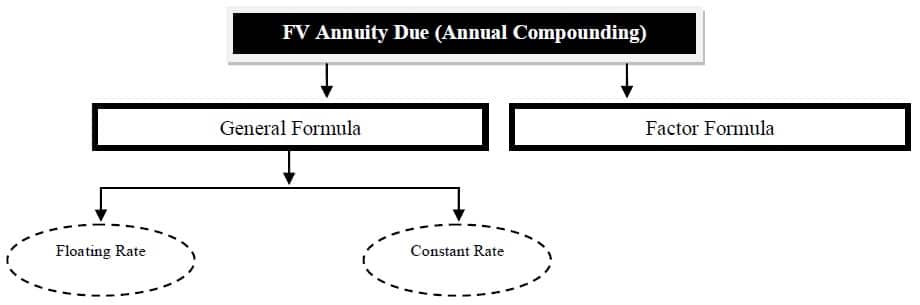

Future value of annuity due (annual compounding)

The value of annuity due at some future time evaluated at a given interest rate assuming that compounding take place one time in a year (annually). Two methods for calculation

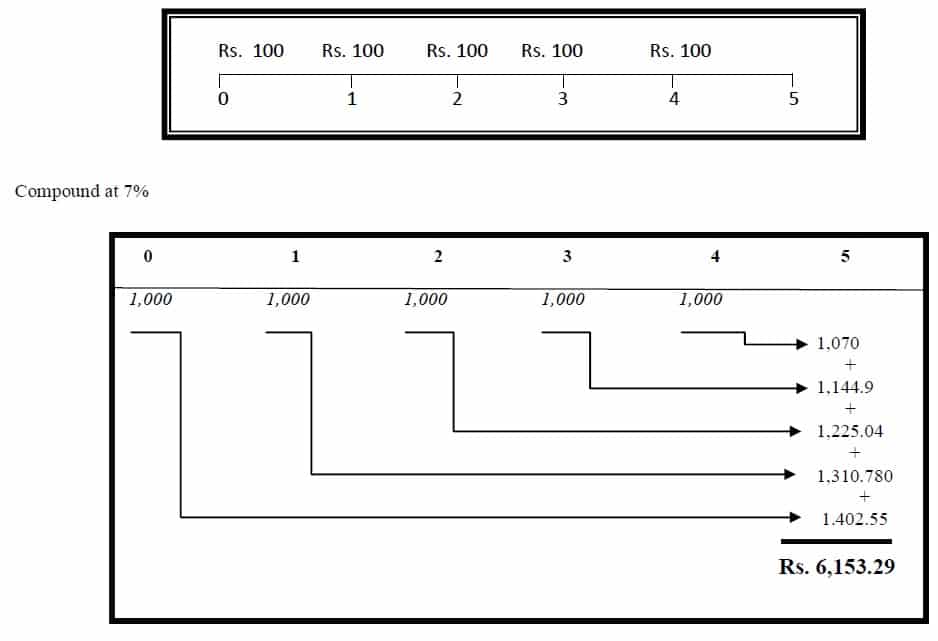

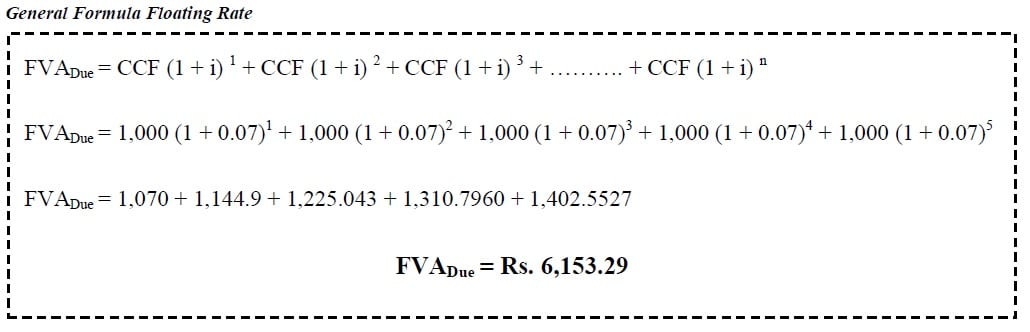

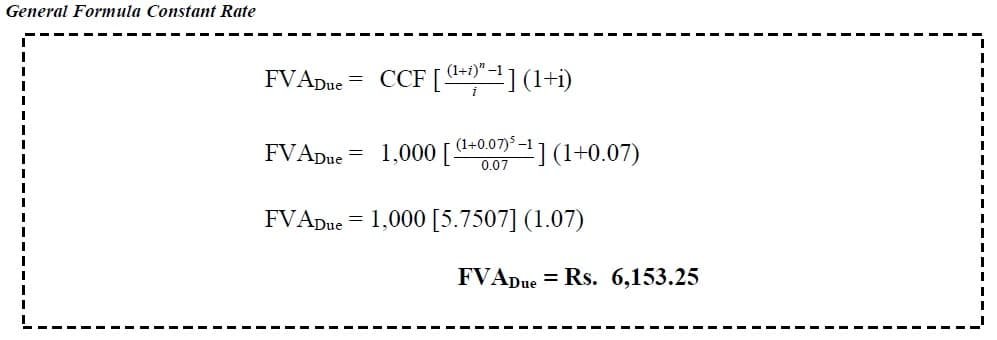

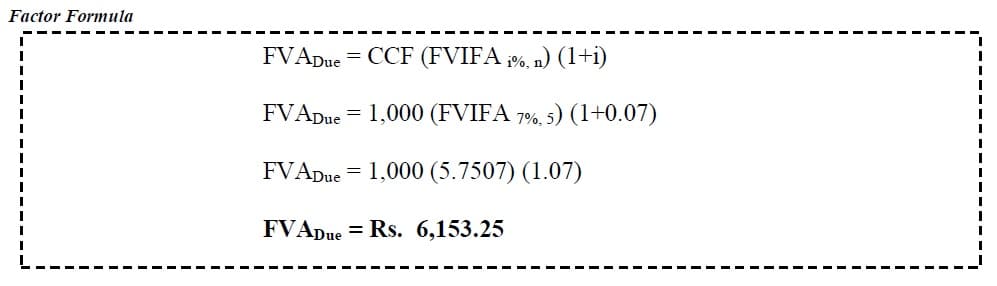

Example # 6:

An annuity makes 5 annual payments of Rs. 1,000 with the first payment coming today. What is the future value of this from now if the interest rate is 7%?

Future Value of Annuity Table Download

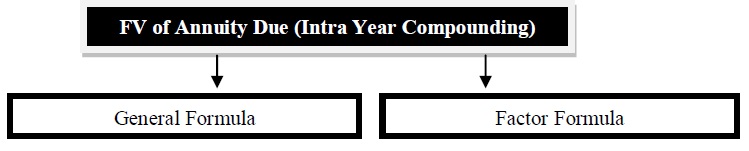

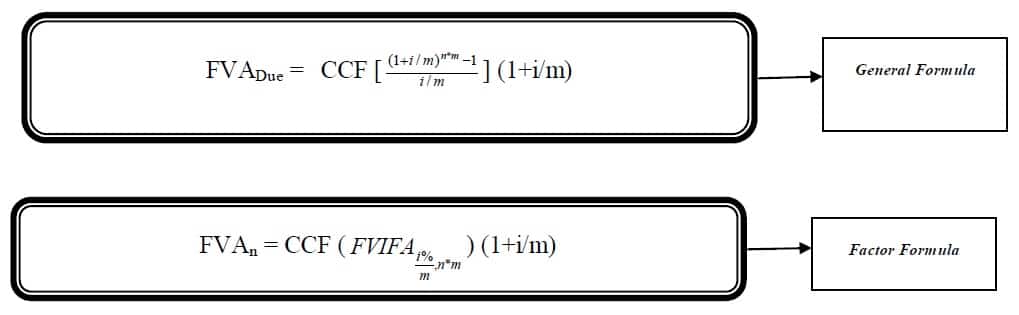

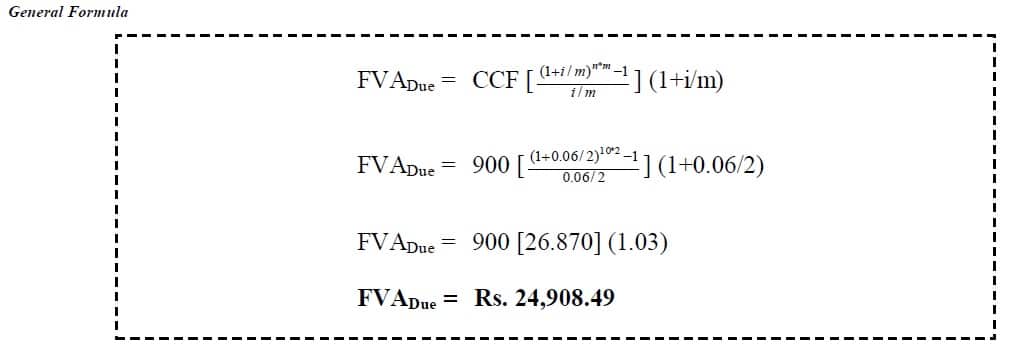

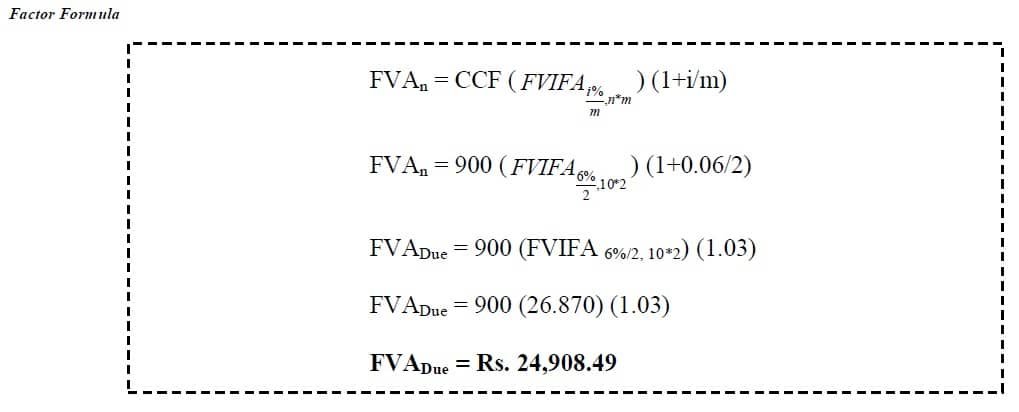

Future value of annuity due (intra-year compounding)

The value of annuity due at some future time evaluated at a given interest rate assuming that compounding take place more than one time in a year (Intra Year). Interest rate reduced while periods of time increase by frequency of compounding (m) i.e. i/m and n*m. Two methods for calculation

Formula

>>> Practice Future Value of Annuity MCQs.

Example # 7:

If 10 annual payments of Rs. 900 are made into saving account that pays 6 percent interest per year. What is the future value of this annuity, if compounding take place semi-annually. Solve this problem by factor formula and table?

Future Value of Annuity Table Download

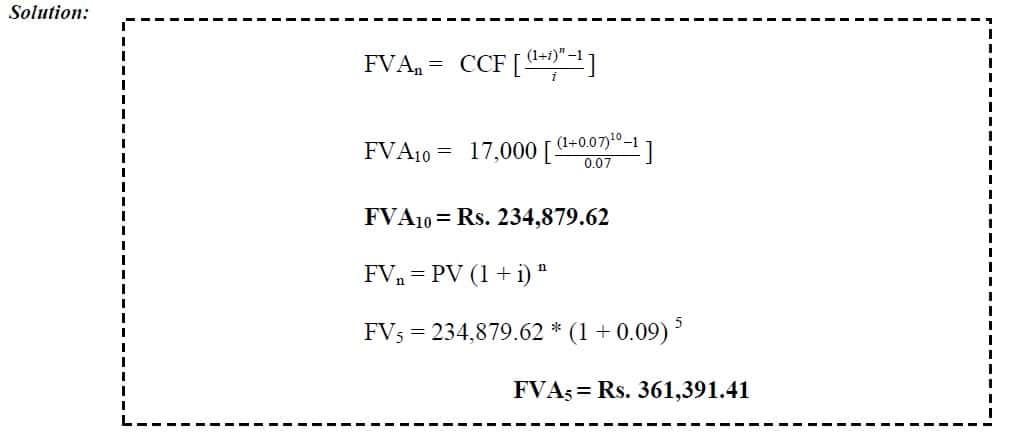

Example # 8:

You deposit Rs. 17,000 each year for 10 years at 7%. Then you earn 9% after that. If you leave the money invested for another 5 years how much will you have in the 15th year?

>> Practice Future Value of Annuity Quiz 1.

Thank you. This information looks great!

Really enjoyed this post.Really looking forward to read more. Awesome.

This is a impressive articles.

I was able to find good information from your content.

It?s hard to find knowledgeable people on this topic, but you sound like you know what you?re talking about! Thanks

This post is invaluable. Where can I find out more?

This is one awesome post.Really thank you! Really Cool.

My partner and I stumbled over here from a different page and thought I

may as well check things out. I like what I see so now i’m following

you. Look forward to checking out your web page repeatedly.

This website was… how do I say it? Relevant!! Finally I’ve found something that helped

me. Thanks a lot!

Thanks for ones marvelous posting! I actually enjoyed reading

it, you can be a great author. I will ensure that I bookmark your blog and may come back at

some point. I want to encourage that you continue your great work, have a

nice morning!

This web site is really a walk-through for all of the info you wanted about this and didn?t know who to ask. Glimpse here, and you?ll definitely discover it.

Hello everyone, it’s my first go to see at this web site, and paragraph is genuinely fruitful for me,

keep up posting these content.

Thank you for this, I am going to surely readily share

the idea with my favorite readers.

When someone writes an article he/she keeps the idea of a

user in his/her brain that how a user can be aware of it.

Therefore that’s why this paragraph is perfect.

Thanks!

Looks realy great! Thanks for the post.

Your guidelines concerning the content are generally enjoyable.

I hope you don’t mind if I talk about a bit of

this content with my subscribers.

Hi there, You have done a fantastic job. I?ll certainly digg it and personally suggest to my friends. I’m sure they will be benefited from this website.

Every weekend i used to pay a quick visit this web site, as i want enjoyment, since this this web site conations genuinely

fastidious funny stuff too.