Depreciation Adjusting Entry

Previous Lesson: Accrual Adjustment

Next Lesson: Bad Debts

Video Lecture: Costing Concepts in Urdu & Hindi-Workbook Practice

Click Here To Download Workbook Used in Video

Click Here To Download Workbook Used in Video

Depreciation is the process of allocating the cost of tangible fixed Assets over its estimated life. Initially the cost of the assets including installation cost is debited to the particular assets. In each accounting year/period a portion of the cost expires and needs Adjusting Entry for showing correct profit for the period and correct value of the asset. Depreciation adjusting entry may be pass by two methods of recording:

- Cost Method

- Written Down Method (WDM)

Example # 1:

On January 1, 2015, Company acquired machinery (a depreciable asset) at a total cost of Rs. 152,000. The estimated salvage value of the asset is Rs. 2,000 and its estimated useful life is five years. Record yearly depreciation?

Solution:

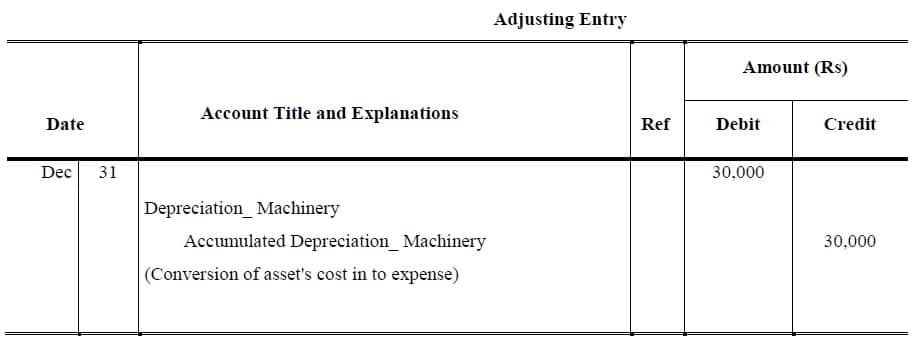

Cost Method

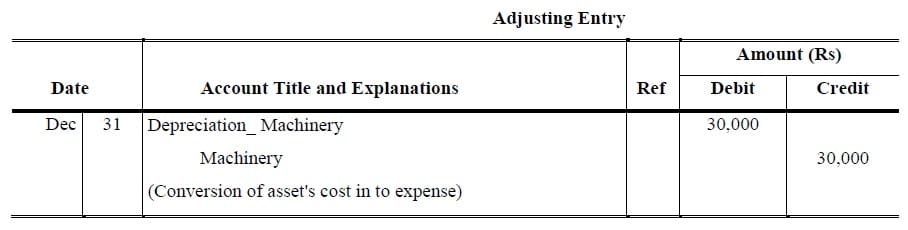

Written Down Method

>>> Practice Adjustment Entries Quiz 3.

>>> Further Practice Adjusting Entries Problems and Solutions.

References

Mukharji, A., & Hanif, M. (2003). Financial Accounting (Vol. 1). New Delhi: Tata McGraw-Hill Publishing Co.

Narayanswami, R. (2008). Financial Accounting: A Managerial Perspective. (3rd, Ed.) New Delhi: Prentice Hall of India.

Ramchandran, N., & Kakani, R. K. (2007). Financial Accounting for Management. (2nd, Ed.) New Delhi: Tata McGraw Hill.

0 Comments